Identity Theft Tax Refund Fraud

Back in January, for Tax Identity Theft Awareness Week, we identified the two major types of tax-related identity fraud: refund fraud, and employment fraud. Earlier this week, we released a new report on identity theft tax refund fraud. In the report, we examined IRS’s estimates about the extent of the problem and the need for information on the costs and benefits of options for combating it.

You can hear our podcast on this report below:

Identity Theft Tax Refund Fraud: a Refresher

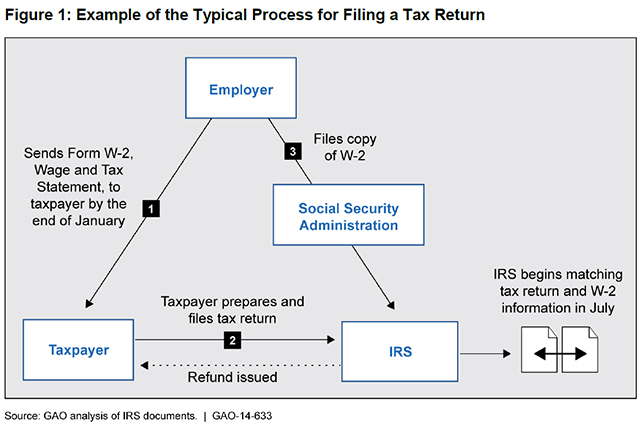

Refund fraud occurs when identity thieves use a stolen Social Security number and other identifying information to file for a tax refund. In this way, identity thieves take advantage of IRS’s “look-back” method of verifying tax returns. After doing some limited reviews, IRS issues a refund and then looks back later to make sure the tax refund claimed is the real thing. IRS usually issues refunds months before it matches wage information on tax returns with information employers reported on Form W-2, as shown in the figure. This “look-back” method helps IRS get refunds to taxpayers quickly, but it can also make the tax system vulnerable to refund fraud.

Excerpted from GAO-14-633

Excerpted from GAO-14-633

Identity Theft Refund Fraud Costs Billions

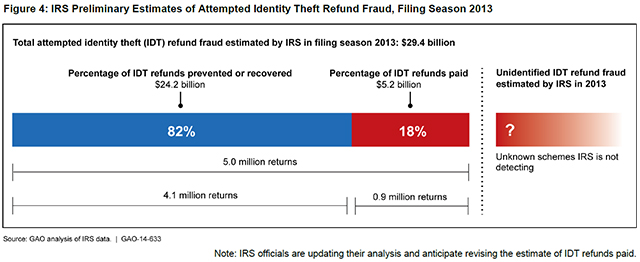

IRS’s preliminary estimates suggest that identity thieves attempted to commit $29.4 billion in identity theft refund fraud in filing season 2013 (see figure below). Of that amount, IRS estimates it paid $5.2 billion in fraudulent identity theft refunds. IRS officials expect that estimate will increase to $5.8 billion after they update their analysis. However, IRS does not know the full extent of the problem because of the challenges inherent in detecting identity theft refund fraud. For example, IRS cannot estimate the amount of identity theft refund fraud for cases where there are no duplicate returns, information returns (such as W-2 forms), or criminal investigations associated with a tax return.

Excerpted from GAO-14-633

Excerpted from GAO-14-633

Protecting Taxpayers from Identity Theft Refund Fraud

Although IRS has developed tools to combat identity theft refund fraud, identity thieves are learning and changing their tactics—which means IRS must respond with new ways to combat fraud. While there are no simple solutions, one option we discuss in our report is matching W-2 information to returns before issuing refunds. One or more of these other steps would have to be taken to make this happen:

- Employers would have to file W-2s sooner (or more employers would have to file W-2s electronically),

- IRS could delay the tax filing season, or

- IRS could delay refunds.

We found that IRS had not yet assessed the costs and benefits of moving up W-2 deadlines or pre-refund matching. However, according to IRS, this strategy could potentially have prevented a substantial portion of the fraudulent refunds in the 2013 filing season.

A future report on this topic will cover other options to help combat identity theft refund fraud.

- Questions on the content of this post? Contact James R. White at whitej@gao.gov.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.