Effects of IRS Challenges on Taxpayers

For most people, today is the last day to file your taxes. IRS has faced many challenges this filing season, including finding better ways to help taxpayers, combating identity theft refund fraud, and navigating new health insurance tax reporting requirements—while facing a continued decline in resources. What does this mean for taxpayers? We break down these issues for you in today’s WatchBlog.

Telephone Service

If you had a burning question to ask IRS about your tax return or refund, you might have waited a long time to talk to someone. IRS projected an average wait time for this year of nearly 1 hour—more than twice as long compared to last year, as shown below.

(Excerpted from GAO-15-420R)

In December 2014, to help improve tax-season telephone service, we recommended that IRS compare its telephone service to the best in business to determine where its actual levels of service fell short. This kind of analysis could also help IRS determine what resources it would need to close the gaps.

Identity Theft (IDT) Refund Fraud

Did you file your taxes this year, only to find a fraudster beat you to it? If so, you may be a victim of IDT refund fraud. Two of our reports included findings on the scope of the problem and potential remedies.

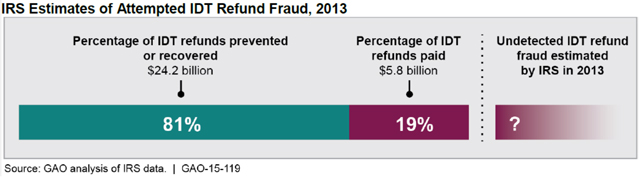

- In January 2015, we found that IRS paid an estimated $5.8 billion in fraudulent tax refunds in 2013, and prevented or recovered $24.2 billion, though the full extent of the problem is unknown.

(Excerpted from GAO-15-119)

- In August 2014, we found that matching W-2 data from employers and others to information provided by tax filers before refunds are issued may prevent billions of dollars in estimated ID theft refund fraud.

Earlier matching and other options, such as improving taxpayer authentication to prevent IDT refund fraud, could have significant costs for taxpayers and IRS. Therefore, more information on the costs, benefits, and tradeoffs would help inform IRS and Congress as to what additional actions are needed.

New Reporting Requirements for Health Care Coverage

This is the first filing season where taxpayers must report their health insurance coverage to IRS. Some taxpayers may owe a penalty if they didn’t have coverage for any month in 2014, while some may receive a tax credit for purchasing health coverage from the marketplaces.

As we reported in February, IRS anticipated some challenges processing this new information, potentially delaying some refunds.

Looking for more information? Check out our AskGAOLive web chat from February on tax filing and IDT refund fraud.

- Questions on the content of this post? Contact: James R. McTigue, Jr. mctiguej@gao.gov.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.