Are You Paying Taxes on Your Virtual Currency?

It’s tax filing season and time to gather your information and fill out your tax forms. But did you know that if you use virtual currency, like bitcoin, you may have to report it to IRS and include it in your taxable income?

Today’s WatchBlog looks at our recent report on how tax laws apply to virtual currency.

How do you know if you have to pay taxes on your virtual currency use? Answer: It depends.

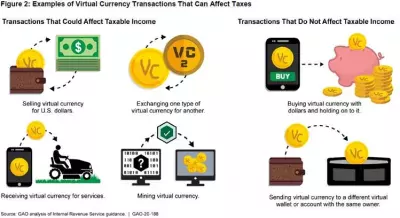

IRS guidance says that virtual currency should be treated like property. So, you need to report income paid in virtual currency because all income is taxable. That also means that if you buy virtual currency and later sell it for a higher price, you may have to pay tax on the difference.

But it’s not always easy to keep track of these virtual currency gains and losses because virtual currency values can fluctuate and taxpayers need to calculate their gains and losses for every transaction. And it gets even more complicated if you had a hard fork (i.e., when a blockchain splits into 2 incompatible versions) or airdrop (i.e., when virtual currency is given out for free, often as a way of promoting new types of virtual currency).We found that IRS’s virtual currency guidance is not always clear for taxpayers. For example, IRS did not mention in its 2019 FAQs that the FAQs could change without notice and that taxpayers cannot fully rely on them. We recommended that IRS address this.

Who reports your virtual currency use to IRS?

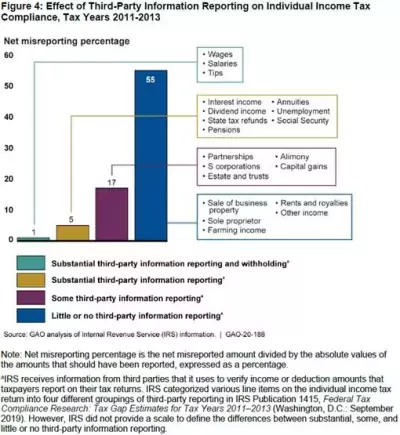

Taxpayers need to report their income to IRS annually, and IRS has found that taxpayers are more likely to do it accurately if someone else, like an employer, financial institution, or another third party, also reports it.

Virtual currency users may have a hard time figuring out their taxable income from virtual currencies because there is limited third-party reporting. This is due to confusion about who is required to report, what they should report, and what tax forms they should use. We recommended that IRS take steps to improve third-party reporting for virtual currencies.

Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.