Blockchain: Financial and Non-Financial Uses and Challenges

Markets—for example the housing market or those for commercial goods—currently rely on institutions like banks or other intermediaries to facilitate transactions. But blockchain technology could reduce the need for these steps, while providing a trusted, tamper-resistant record of transactions.

While this emerging technology could help level the playing field for businesses of all sizes or enable greater financial inclusion, it also faces some challenges and poses some risks to the consumers and businesses that hope to use it.

In today’s WatchBlog post, we look at blockchain technology, including the benefits, challenges, and risks surrounding its use.

Image

What is blockchain?

Blockchain is not a new technology but instead an innovative way of using existing, mature technologies. Its core function is to create a tamper-resistant ledger for digital assets, such as cryptocurrency.

There are two types of blockchain implementations: public (sometimes known as “permissionless”) and private (“permissioned”). Public blockchains can be used by cryptocurrencies such as Bitcoin, and anyone can add to the chain. Private blockchains are generally used by institutions (such as companies or government agencies) and have restrictions around who can participate in the network.

Financial blockchain applications

The most well-known applications of blockchain are in the financial sector. When people think of blockchain, they may also think of cryptocurrencies like Bitcoin. Cryptocurrencies are a type of digital representation of value that uses blockchain technology to act as an investment or money. These uses may lead to cost savings, expanded access to financial products, and other transformational changes.

Unfortunately, several risks and challenges may prevent these benefits from being realized, or may even lead to negative consequences for users and the financial system. These include risks for users and to the broader financial system, due to a current lack of consumer protections, and the ability to use the technology to facilitate illegal activity.

Potential non-financial blockchain applications

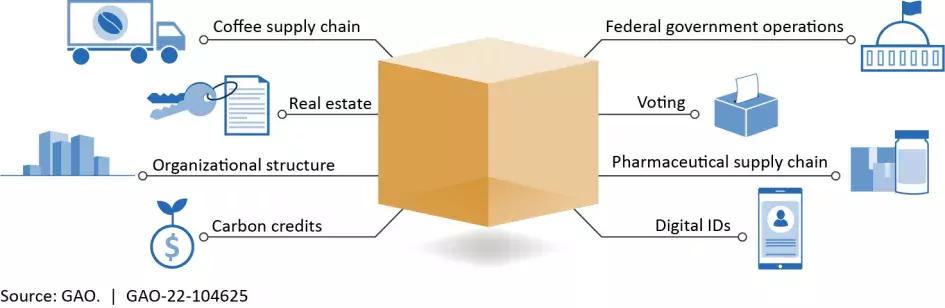

Blockchain has potential non-financial applications. For example, blockchain could help combat counterfeit medicines and trace food-borne illnesses. Governments could use it to maintain property records or to improve information sharing. Blockchain could also be used to create new kinds of non-hierarchical organizations (i.e., those without clear management titles such as Chief Executive Officer).

Blockchain has many potential non-financial applications

Image

However, in our review of some applications, we found that blockchain did not resolve a majority of the critical challenges associated with each application. We also found that blockchain can introduce new challenges. For example, it could end up excluding people who do not have internet or computer access.

Additionally, not many of the non-financial blockchain systems we looked at have made it out of the pilot stage. For example, the Department of the Treasury’s blockchain pilot was designed to increase payment efficiency and reduce reporting requirements for federal grantees. There were two reasons. The selected type of blockchain was inconsistent with National Institute of Standards and Technology cryptographic standards, and there is currently no legal authority allowing the system to operate.

Policy challenges and how to address them

We’ve developed four policy proposals to help enhance the potential benefits and mitigate the challenges of blockchain technology. These proposals are for policymakers of all backgrounds—including Congress, state and local governments, and leaders in business, academia, and nonprofit institutions.

- Policymakers could consolidate blockchain standards. This could help make it easier for organizations trying to use blockchain to integrate the technology with their existing systems.

- Policymakers could either clarify existing rules and regulations or create new ones around blockchain. This could reduce the current uncertainty around how different implementations of the technology might be regulated, which could help companies and others feel more comfortable about adopting blockchain solutions.

- Policymakers could support the development of blockchain educational materials. This could help users avoid common blockchain scams and companies be more able to find talent to help them implement the technology.

- Policymakers could consider using blockchain to meet their own specific goals. This could help public and private-sector institutions determine whether the technology could help resolve specific problems.

Want to learn more about blockchain technology? Check out our new technology assessment on blockchain here.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.