China’s Foreign Investments Significantly Outpace the United States. What does that mean?

China is the world's largest investor in other countries—providing funding to build infrastructure like roads and railways, energy supplies, telecommunications, and more. Through these efforts China has expanded its influence globally, posing significant challenges to the United States’ economic, political, and security interests.

Today’s WatchBlog post looks at our recent report on China’s investments and what they mean for the United States.

Image

China’s investments can help now, hurt later

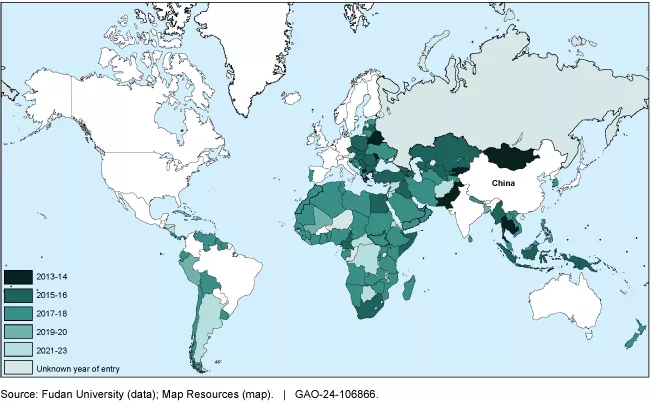

Through its Belt and Road Initiative, China invested $679 billion on infrastructure projects in nearly 150 countries, between 2013 and 2022. These investments can have meaningful economic impacts, as well as help address some immediate and critical infrastructure needs for developing countries.

But, these projects have sometimes contributed to unsustainable debt, labor issues, and environmental degradation.

Countries that signed agreements with China to join its Belt and Road Initiative, by year of entry

Image

Unsustainable debt. China is the world’s largest debt collector, with outstanding borrower debt sitting between $1.1 and $1.5 trillion. But countries receiving Chinese investments may end up with unsustainable debt that leaves them no choice but to support Chinese global goals. Leaders we spoke with told us that the agreements their country made with China were often opaque. Officials were surprised by high interest rates and unsure of the exact amount their country owed. This lack of transparency can lead to corruption. For example, agreements often exclude public reporting of principal and interest amounts and limit civil society oversight.

Labor issues from China’s transportation projects: China is also helping connect countries through road and railroad development. For example, China funded the Nairobi-Mombasa Standard-Guage Railway—the largest infrastructure project in Kenya since it gained independence from Britain in 1963.

While transportation projects can be transformative, Chinese-funded projects often do not create jobs for local workers or share knowledge of infrastructure development with the countries receiving funds. Some countries’ officials told us that these projects offer limited employment and training opportunities for local workers. For example, in Indonesia, the Jakarta-Bandung high-speed train relied heavily on Chinese labor—so much so that construction was halted during COVID-19 after Chinese workers returned home.

Image

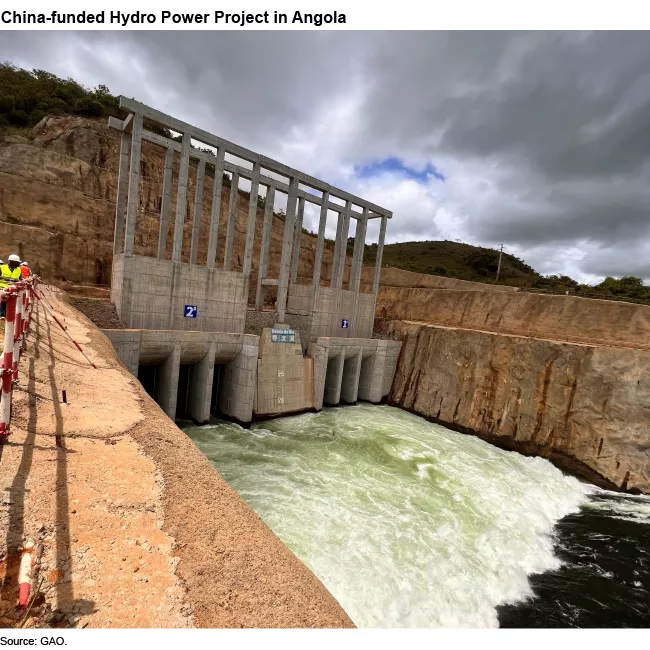

Environmental effects from China’s energy investments: China is the top investor in global energy—financing 226 power plants in 64 countries between 2013 and 2022. For example, China’s investments in Angola have increased energy production there. This growth may eventually allow Angola to export surplus energy to southern Africa.

While China has helped some countries move to renewable sources of energy—such as solar and wind, it is the world’s largest source of financing for coal-fired power plants. Other international donors have reduced their support for energy sources, like coal and hydro, that have negative environmental or social impacts.

Image

Preventing competition in telecommunications: Many developing countries desperately need telecommunications infrastructure. China’s investments have allowed fast construction of networks and have given China a long-term foothold in other countries. For example, China’s telecommunication projects use Chinese technical standards that are incompatible with those of other countries, including the U.S. This control of telecommunications networks enables China to potentially use the networks to gather intelligence or exert influence on the country to act in a manner that suits China.

China continues to invest in global infrastructure, and while it has taken steps to address some of the more egregious environmental and labor-related issues, China is growing its network of indebted countries through which it can exert influence, extract resources, and move military and market forces.

China’s Investments through the Belt and Road Initiative by Type, 2013-2021

Image

What can the U.S. do in response to China’s growing global influence?

The United States spent $76 billion compared to China’s $679 billion on similar global infrastructure projects—like those in transportation, energy, communication, industry, water supply and sanitation, as well as mining and construction. The U.S. can’t outspend China. But it also doesn’t need to, according to GAO’s Nagla’a El-Hodiri. Listen to our interview with Nagla’a in the podcast below.

We met with experts and stakeholders on this issue, and they provided suggestions on what the U.S. could do to strengthen its approach to investments.

Take on some more risk. The U.S. follows various standards for selecting international infrastructure projects while avoiding risky investments. Experts told us that the United States can tolerate more risk and shorten the investment approval process while still protecting its interests.

Put boots on the ground, globally. Increasing the federal on-the-ground presence abroad can help better position the U.S. to learn about potential projects. It also allows agencies to react more quickly to these opportunities and develop relationships with host country leadership.

Coordinate between agencies and adopt a shared plan. Most U.S. international investment efforts are split across six federal agencies. A national strategy could help agencies collaborate by clearly defining roles, investment goals, and standards for projects. In addition, part of the appeal of China’s Belt and Road Initiative is the expediency and flexibility the program offers. The average project funded through this initiative takes approximately 3 years to complete. Similar projects funded by World Bank and other regional development banks have taken 5 to 10 years to complete. A shared plan will also speed up U.S. efforts to gain ground in the global infrastructure space.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.