Federal Debt Has Reached its Ceiling. What Does That Mean?

In the Bipartisan Budget Act of 2019, Congress suspended the federal debt ceiling through July 31, 2021. As of August 1, federal debt has reached the statutory limit or ceiling.

Today’s WatchBlog post looks at what it means for federal debt to reach the ceiling and alternative approaches that we have suggested lawmakers could consider to better manage financing of the debt and protect the full faith and credit of the United States.

What is the debt ceiling?

Congress and the President set a single limit on the amount of debt the Department of the Treasury (Treasury) can issue, creating the debt ceiling. This provides the Treasury with the flexibility that it needs to manage federal debt on a day-to-day basis within this overall limit.

However, as we have previously reported, there are 2 significant drawbacks to this approach:

- The debt ceiling does not control the amount of debt. Instead, it is an after-the-fact measure that restricts the Treasury’s ability to borrow to finance the decisions already enacted by Congress and the President.

- Delays in raising the debt ceiling can disrupt financial markets, increase U.S. borrowing costs, and threaten the full faith and credit of the United States.

Image

Now that the debt ceiling has been reached, what happens next?

There are a number of extraordinary measures that the Treasury can use to temporarily manage debt near the ceiling. For example, it can temporarily suspend certain investments to federal employee retirement funds and cash out some of its own investments earlier than normal. But once all extraordinary measures are exhausted, the Treasury can’t do anything else without action from Congress.

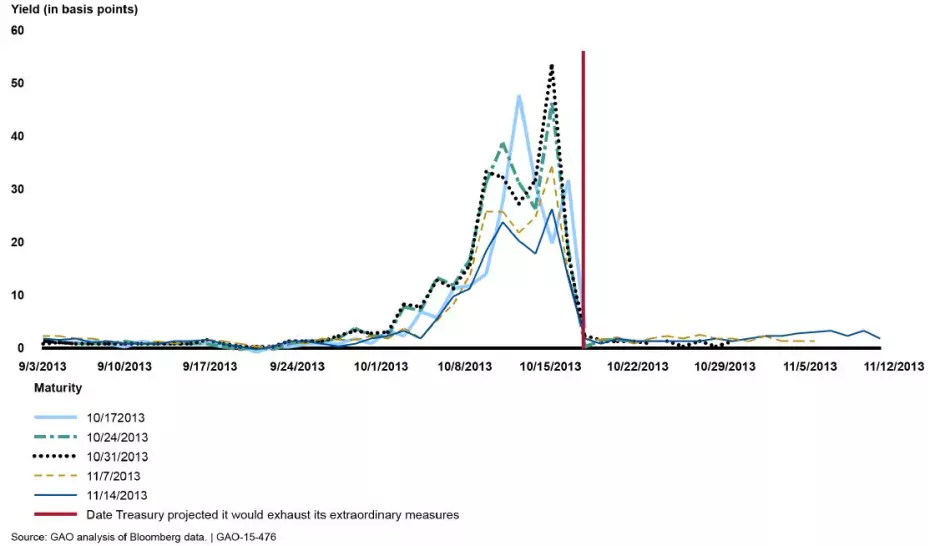

We have reported that delays in raising the debt ceiling can disrupt financial markets—even if action is taken in time to pay investors. For example, in 2013, as the date when Treasury’s extraordinary action would be exhausted drew nearer, investors feared not being paid on time and reported avoiding certain Treasury securities. Investors who did purchase these Treasury securities demanded a greater return to compensate for the increased risk. This ultimately added costs for American taxpayers.

Figure: Secondary Market Yields on Treasury Bills Maturing in Late October through Mid-November 2013 (in Basis Points)

Image

In 2019, 72% of the investors that we surveyed reported that they anticipated they would take similar actions, such as avoiding certain Treasury securities, to manage future delays in raising the debt ceiling.

If delays persist and Treasury’s extraordinary measures are exhausted, it could be forced to delay or even default on payments to investors until money becomes available. A default would have devastating effects on U.S. and global economies and the public. It would immediately and significantly decrease demand for Treasury securities and increase costs. We have reported numerous times that the full faith and credit of the United States must be preserved.

Alternative approaches for managing the national debt

Through interviews of budget and policy experts and an interactive web forum, we identified 3 potential approaches:

- Link action on the debt ceiling to the budget resolution so decisions on borrowing and spending are made at the same time.

- Allow any administration to propose raises to the debt ceiling, subject to a congressional motion of disapproval.

- Allow any administration to borrow as necessary to fund laws enacted by Congress and the president.

These alternative approaches would better link decisions about the debt ceiling with decisions about spending and revenue at the time those decisions are made. They would also minimize disruptions to the market.

Experts have also suggested replacing the debt ceiling with a fiscal rule imposed on spending and revenue decisions. We have previously testified that Congress could consider this change as part of a broader plan to put the government on a more sustainable fiscal path.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.