As Student Loan Payment Pause Ends, Income-Driven Repayment Plans May Help Borrowers

The federal student loan payment pause ends this month. Interest on loans will begin accruing (again) in September and payments will be due starting in October—for the first time since March 2020. After the more than 3-year pause, many borrowers may be worried about how to manage monthly payments, which can be hundreds of dollars. Income-Driven Repayment plans are a popular option for repayment and can make monthly payments more affordable.

Borrowers with federal student loans totaling more than $500 billion are using these plans, which are eligible for forgiveness after borrowers make up to 20 or 25 years of qualifying payments.

Today’s WatchBlog post takes a look at what you should know about Income-Driven Repayment plans and our work on recent changes to these options.

Image

How do Income-Driven Repayment plans work?

Monthly payments for Income-Driven Repayment (IDR) plans are based on a borrower’s income and family size. Unlike Standard repayment, which typically requires repayment over 10 years, the repayment periods for IDR plans can be up to 20 or 25 years. And also unlike other repayment plans that require the loan to be repaid in full over time, IDR plans offer forgiveness of the loans balance at the end of the repayment period. Monthly payments can be as low as $0 for some borrowers and still count toward forgiveness.

Borrowers enrolled in IDR plans do not have to apply for forgiveness. The Department of Education and the loan servicers it contracts with are responsible for identifying borrowers on these plans who have made enough qualifying payments to receive forgiveness.

The Department of Education currently offers four Income-Driven Repayment plans. Their differences include the percentage of income used to calculate monthly payments amounts and years required for repayment:

- Saving on a Valuable Education (SAVE)—Formerly known as Revised Pay As You Earn, this newly updated plan requires payments that are generally 10% of your discretionary income. The remaining unpaid balance of loans is forgiven after 20 or 25 years. (Starting in 2024, the terms are expected to change to 5% of your discretionary income for payments on undergraduate loans, and unpaid balances will be forgiven after 10 years for borrowers with original principal balances of $12,000 or less.)

- Income-Contingent Repayment (ICR)—Payments are 20% of your discretionary income or what you would pay on a repayment plan with a fixed payment over the course of 12 years, adjusted according to your income. The remaining unpaid balance of loans is forgiven after 25 years

- Income-Based Repayment (IBR)—Depending on when you first took out loans (before or on or after July 1, 2014), payments are generally 10% or 15% of the borrower’s discretionary income, but never more than the 10-year Standard repayment plan amount. The remaining unpaid balance of loans is forgiven after 20 or 25 years.

- Pay As You Earn (PAYE)—Payments are generally 10% of your discretionary income, but never more than the 10 year Standard repayment plan amount. The remaining unpaid balance of loans is forgiven after 20 years.

You can find out more about which plan is the best fit for you and apply for a plan by visiting the Department of Education’s website.

How have Income-Driven Repayment plans changed in recent years?

In March 2022, we reported on the Department of Education’s efforts to ensure eligible borrowers received loan forgiveness under Income-Driven Repayment plans. We found that the department had trouble tracking borrowers’ payments and hadn’t done enough to ensure that all eligible borrowers received the forgiveness they were entitled to.

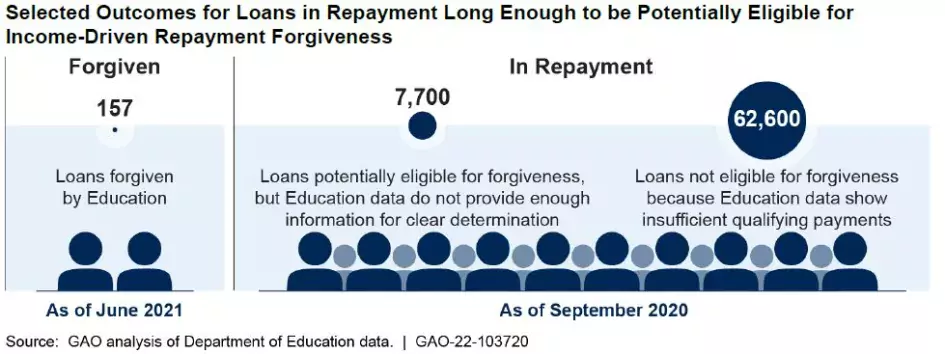

When we looked at the number of loans that had received forgiveness under an IDR plan, we found that only 157 loans had received forgiveness as of June 2021, and that thousands of borrowers still in repayment may have been eligible for forgiveness. Department of Education officials said data limitations make it difficult to track some qualifying payments and older loans were at higher risk for payment tracking errors.

Image

Since our March 2022 report—which included recommendations for improving payment tracking—the Department of Education has taken steps to address this issue. In April 2022, the department announced plans to conduct a one-time revision to IDR payment counts to address past inaccuracies and permanently fix payment counting going forward. As part of this effort, the department recently began the process of notifying and providing 804,000 borrowers with $39 billion in IDR forgiveness.

In our March 2022 report, we also made recommendations to ensure borrowers received the information they need about IDR forgiveness. Specifically, Education needs to provide borrowers with additional information about requirements for forgiveness and their progress toward it.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.