Small Business Administration: Leadership Attention Needed to Overcome Management Challenges

Highlights

What GAO Found

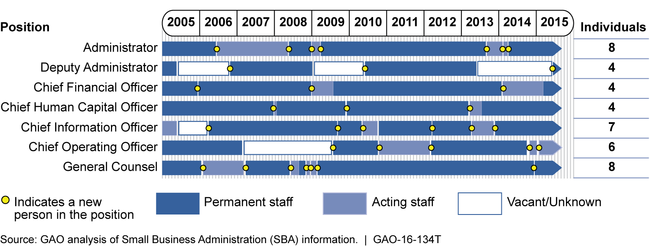

As GAO reported in September 2015, the Small Business Administration (SBA) has not resolved many of its long-standing management challenges due to a lack of sustained priority attention over time. Frequent turnover of political leadership in the federal government, including at SBA, has often made sustaining attention to needed changes difficult (see figure below). Senior SBA leaders have not prioritized long-term organizational transformation in areas such as human capital and information technology (IT). For example, at a 2013 hearing on SBA's budget, the committee Chairman stated that SBA's proposed budget focused on the agency's priorities but ignored some long-standing management deficits. This raises questions about SBA's sustained commitment to addressing management challenges that could keep it from effectively assisting small businesses.

Turnover in Senior-Level Positions at SBA, 2005 through 2015

Many of the management challenges that GAO and the SBA Office of Inspector General (OIG) have identified over the years remain, including some related to program implementation and oversight, contracting, human capital, and IT. SBA has generally agreed with prior GAO recommendations that were designed to address these issues and other challenges related to the lack of program evaluations. The agency had made limited progress in addressing most of these recommendations but had recently begun taking some steps. A senior SBA official told GAO that improving human capital management, IT, and the 8(a) program (a business development program) were priorities for the current administrator. For example, he stated that SBA was exploring creative ways to recruit staff and plans to expand SBA One—a database currently used to process loan applications—to include the 8(a) program. Also, SBA had begun addressing some internal control weaknesses that GAO and the SBA OIG identified as contributing to the agency's management challenges. SBA officials noted that the agency had begun to update its standard operating procedure (SOP) on internal controls and planned more revisions after the Office of Management and Budget (OMB) updated its Circular A-123, which is expected to include guidance on implementing GAO's 2014 revisions to federal internal control standards. OMB issued a draft of the revised circular in June 2015 and as of September 2015 was reviewing comments it received.

In September 2015, GAO maintained that 69 recommendations it made in prior work continued to have merit and should be fully implemented. As of December 2015, SBA had implemented 7 of these recommendations, including those pertaining to disaster assistance and Small Business Innovation Research. For example, SBA revised its planning documents to adjust staffing and resources available for future disasters by considering the potential effect of early application submissions for disaster loans as GAO recommended. Such action should help improve the agency's timely response to disasters. In addition, SBA had initiated actions in response to the eight new GAO recommendations. For example, SBA officials told GAO that the agency had established an Economic Impact Evaluation Working Group, which was developing evaluation plans for several program offices.

|

GAO identified management areas in which SBA had not incorporated key principles or made other improvements, including: |

|

|

|

Why GAO Did This Study

SBA has provided billions of dollars in loans and guarantees to small businesses. GAO has previously reported on management challenges at SBA. In this testimony, which is based on a September 2015 report (GAO-15-347) and related updates on the status of recommendations, GAO discusses (1) the extent to which SBA has addressed previously identified management challenges; and (2) SBA’s management of its strategic planning, human capital, organizational structure, enterprise risk, procedural guidance, and IT. To conduct this work, GAO reviewed prior GAO and SBA Office of Inspector General reports on SBA programs, examined relevant SBA documents, and interviewed agency officials.

Recommendations

In its September 2015 report, GAO made eight recommendations designed to improve SBA’s program evaluations, strategic and workforce planning, training, organizational structure, enterprise risk management, procedural guidance, and oversight of IT investments. SBA generally agreed with these recommendations and provided additional information about its recent efforts to complete its organizational assessment. In response, GAO clarified its recommendation that SBA document its assessment, including the results and any planned organizational changes. GAO also maintains that 62 recommendations it made in prior reports still have merit and should be fully implemented.