Federal Fees, Fines, and Penalties: Observations on Agency Spending Authorities

Fast Facts

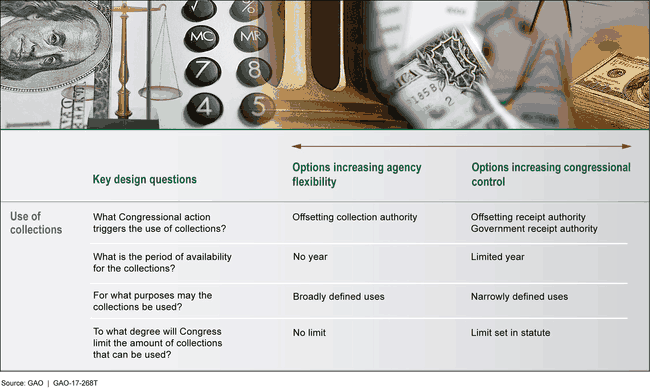

While the majority of federal revenues come from taxes, agencies also collect billions of dollars in fees, fines, penalties, and settlements. We've looked at the options available for legislating the use of these funds.

In this testimony, we outlined the options and explored the tradeoffs involved with each. For example, requiring these funds to go through the annual appropriation process could make it easier for Congress to oversee the money. Conversely, allowing use of the funds without further congressional action could help an agency respond more quickly to customers or changing conditions.

Key Design Decisions for the Use of Federal Fees, Fines, and Penalties

Table showing options that either increase agency flexibility or increase congressional control.

Highlights

What GAO Found

GAO's prior work has identified four key design decisions related to how fee, fine, and penalty collections are used that help Congress balance agency flexibility and congressional control.

Key Design Decisions for Use of Collections

One of these key design decisions is the congressional action that triggers the use of collections. The table below outlines the range of structures that establish an agency's use of collections and examples of fees, fines, and penalties for each structure.

Design Decision on Agency Use of Fees, Fines, and Penalties and Related Examples

|

Design decision: Congressional action triggering use of collections |

Example of fee, fine, or penalty |

|

Collections deposited to the Treasury as miscellaneous receipts |

Civil monetary penalty payments from financial institutions received by certain financial regulators |

|

Collections dedicated to the related program with availability subject to further appropriation |

Food and Drug Administration prescription drug user fees |

|

Collections dedicated to the related program and available without further congressional action (i.e., a permanent appropriation) |

National Park Service fees |

|

Collections available based on a combination of these authorities |

Department of Justice Drug Enforcement Administration Diversion Control fees |

Source: GAO analysis of applicable laws ǀ GAO-17-268T

As GAO has previously reported, these designs involve different tradeoffs and implications. For example, requiring collections to be annually appropriated before an agency can use the collections increases opportunities for congressional oversight on a regular basis. Conversely, if Congress grants an agency authority to use collections without further congressional action, the agency may be able to respond more quickly to customers or changing conditions. Even when an agency has the permanent authority to use collections, the funds remain subject to congressional oversight at any point in time and Congress can place limitations on obligations for any given year.

Why GAO Did This Study

Congress exercises its constitutional power of the purse by appropriating funds and prescribing conditions governing their use. Through annual appropriations and other laws that constitute permanent appropriations, Congress provides agencies with authority to incur obligations for specified purposes. The federal government receives funds from a variety of sources, including tax revenues, fees, fines, penalties, and settlements. Collections from fees, fines, penalties, and settlements involve billions of dollars and fund a wide variety of programs.

The design and structure—and corresponding agency flexibility and congressional control—of these statutory authorities can vary widely. In many cases, Congress has provided agencies with permanent authority to collect and obligate funds from fees, fines, and penalties without further congressional action. This authority is a form of appropriations and is subject to the fiscal laws governing appropriated funds. In addition, annual appropriation acts may limit the availability of those funds for obligation. Given the nation's fiscal condition, it is critical that every funding source and spending decision be carefully considered and applied to its best use.

This testimony provides an overview of key design decisions related to the use of federal collections outlined in prior GAO reports, with examples of specific fees, fines, and penalties from GAO reports issued between September 2005 and November 2016.

For more information, contact Heather Krause at (202) 512-6806 or krauseh@gao.gov or Edda Emmanuelli Perez at (202) 512-2853 or emmanuellipereze@gao.gov.