Low-Income Housing Tax Credit: Improved Data and Oversight Would Strengthen Cost Assessment and Fraud Risk Management

Fast Facts

Developers can apply for federal Low-Income Housing Tax Credits to help them build affordable housing projects. The amount of credit depends largely on project costs.

Project costs we looked at varied widely (shown below), and federal oversight of costs is limited. Federal and state agencies could use data on variables that affect cost—such as square footage and building type—to better monitor the tax credit. State agencies that administer the credit aren't required to report the kind of detailed cost data that could reduce fraud risks.

We recommended ways to make better data available to the government and improve oversight of the credit.

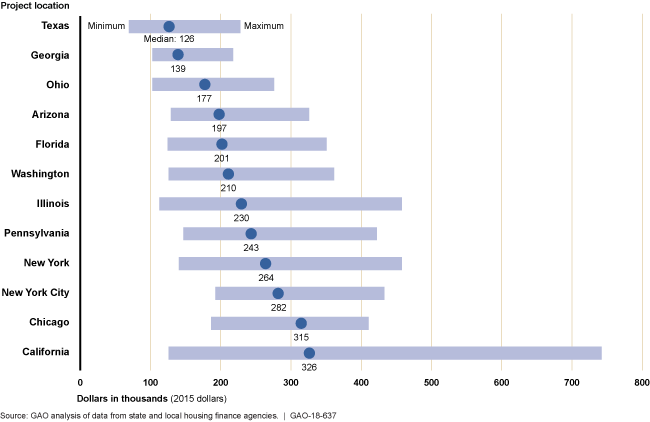

Development Costs (per unit) for New Rental Housing Built with Funding That Included Tax Credits, Selected States and Cities, 2011–2015

Figure showing maximum, minimum & median project costs for selected states and cities, with TX and GA lowest and CA highest.

Highlights

What GAO Found

GAO identified wide variation in development costs and several cost drivers for Low-Income Housing Tax Credit (LIHTC) projects completed in 2011–2015. Across 12 selected allocating agencies, median per-unit costs for new construction projects ranged from about $126,000 (Texas) to about $326,000 (California). Within individual allocating agencies, the variation in per-unit cost between the least and most expensive project ranged from as little as $104,000 per unit (Georgia) to as much as $606,000 per unit (California). After controlling for other characteristics, GAO estimates that

larger projects (more than 100 units) cost about $85,000 less per unit than smaller projects (fewer than 37 units), consistent with economies of scale.

projects in urban areas cost about $13,000 more per unit than projects in nonurban areas.

projects for senior tenants—nearly one-third of all projects—cost about $7,000 less per unit than those for other tenants, potentially due to smaller unit sizes.

Allocating agencies use measures such as cost and fee limits to oversee LIHTC development costs, but few agencies have requirements to help guard against misrepresentation of contractor costs (a known fraud risk). LIHTC program policies, while requiring high-level cost certifications from developers, do not directly address this risk because the certifications aggregate costs from multiple contractors. Some allocating agencies require detailed cost certifications from contractors, but many do not. Because the Internal Revenue Service (IRS) does not require such certifications for LIHTC projects, the vulnerability of the LIHTC program to this fraud risk is heightened.

Weaknesses in data quality and federal oversight constrain assessment of LIHTC development costs and the efficiency and effectiveness of the program. GAO found

inconsistencies in the types, definitions, and formats of cost-related variables 12 selected agencies collected.

allocating agencies did not capture the full extent of a key indirect cost—a fee paid to syndicators acting as intermediaries between project developers and investors that IRS requires be collected.

IRS does not require allocating agencies to collect and report cost-related data that would facilitate programwide assessment of development costs. Further, Congress has not designated any federal entity to maintain and analyze LIHTC cost data.

Even without a designated federal entity, opportunities exist to advance oversight of development costs. In particular, greater standardization of cost data would lay a foundation for allocating agencies to enhance evaluation of cost drivers and cost-management practices.

Why GAO Did This Study

LIHTCs encourage private investment in low-income rental housing and have financed about 50,000 housing units annually since 2010.The LIHTC program is administered by IRS and credit allocating agencies (state or local housing finance agencies). The program has come under increased scrutiny following reports of high or fraudulent development costs for certain LIHTC projects. GAO was asked to review the cost-efficiency and effectiveness of the LIHTC program.

This report examines (1) development costs for selected LIHTC projects and factors affecting costs, (2) allocating agencies' oversight of costs, and (3) factors limiting assessment of costs. GAO compiled and analyzed a database of costs and characteristics for 1,849 projects completed in 2011–2015 (the most recent data available when compiled) from 12 allocating agencies. The agencies span five regions and accounted for about half of the LIHTCs available for award in 2015. GAO also reviewed the most recent allocating plans and related documents for 57 allocating agencies and reviewed federal requirements.

Recommendations

Congress should consider designating a federal agency to maintain and analyze LIHTC cost data. GAO also makes three recommendations to IRS to enhance collection and verification of cost data. IRS disagreed with the recommendations and said it lacked certain data collection authorities. GAO maintains the recommendations would strengthen program oversight and integrity and modified one of them to allow IRS greater flexibility in promoting data standards.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider designating an agency to regularly collect and maintain specified cost-related data from credit allocating agencies and periodically assess and report on LIHTC project development costs. (Matter for Congressional Consideration 1) | As of March 2024, Congress had not designated an agency to regularly collect and maintain data on LIHTC project development costs. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | IRS's Associate Chief Counsel, in consultation with Treasury's Assistant Secretary for Tax Policy, should require general contractor cost certifications for LIHTC projects to verify consistency with the developer cost certification. (Recommendation 1) |

IRS disagreed with the recommendation and had not taken action to implement it as of August 2024. We maintain that requiring general contractor cost certifications would help address a known fraud risk.

|

| Internal Revenue Service | To help allocating agencies analyze development cost trends and drivers and make comparisons to other agencies, IRS's Commissioner of the Small Business/Self-Employed Division should encourage allocating agencies and other LIHTC stakeholders to collaborate on the development of more standardized cost data, considering information in this report about variation in data elements, definitions, and formats. (Recommendation 2) |

IRS disagreed with the recommendation and had not taken action to implement it as of August 2024. We maintain that greater standardization of LIHTC cost data would facilitate analysis of cost drivers and cost-management practices.

|

| Internal Revenue Service | IRS's Associate Chief Counsel, in consultation with Treasury's Assistant Secretary for Tax Policy, should communicate to credit allocating agencies how to collect information on and review LIHTC syndication expenses, including upper-tier partnership expenses. (Recommendation 3) |

IRS disagreed with the recommendation and had not taken action to implement it as of August 2024. We maintain that communicating expectations about the collection and review of syndication expenses would enhance program transparency and allocating agency financial assessments.

|