Public Service Loan Forgiveness: Improving the Temporary Expanded Process Could Help Reduce Borrower Confusion

Fast Facts

The Public Service Loan Forgiveness program is one way to encourage public service. It forgives federal student loan balances for eligible borrowers who have made 10 years of payments while in certain public service jobs.

In 2018, after few loans were forgiven, Congress temporarily expanded the program to include more borrowers. But some borrowers may not know about the temporary program because most loan servicers’ websites don’t have information on it. Also, applying is a potentially confusing multi-step process.

Our recommendations are to make more information available and combine application steps to make it less confusing for borrowers.

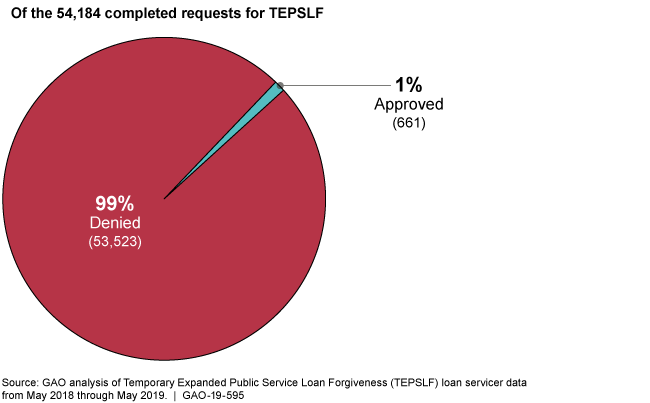

1% of Temporary Expanded Public Service Loan Forgiveness requests were approved

Pie chart showing 99 percent denied and 1 percent approved

Highlights

What GAO Found

The Department of Education's (Education) process for obtaining Temporary Expanded Public Service Loan Forgiveness (TEPSLF) is not clear to borrowers. Established in 2007, the Public Service Loan Forgiveness (PSLF) program forgives federal student loans for borrowers who work for certain public service employers for at least 10 years while making 120 payments via eligible repayment plans, among other requirements. In 2018, Congress funded TEPSLF to help borrowers who faced barriers obtaining PSLF loan forgiveness because they were on repayment plans that were ineligible for PSLF. Congress also required Education to develop a simple method for borrowers to apply for TEPSLF. Education established a process for borrowers to initiate their TEPSLF requests via e-mail. The agency also required TESPLF applicants to submit a separate PSLF application before it would consider their TEPSLF request. Agency officials said they established this process to quickly implement TEPSLF and obtain the information needed to determine borrower eligibility. However, the process can be confusing for borrowers who do not understand why they must apply separately for PSLF—a program they are ineligible for—to be eligible for TEPSLF. Requiring borrowers to submit a separate PSLF application to pursue TEPSLF, rather than having an integrated request such as by including a checkbox on the PSLF application for interested borrowers, is not aligned with Education's strategic goal to improve customer service to borrowers. As a result, some eligible borrowers may miss the opportunity to have their loans forgiven.

As of May 2019, Education had processed about 54,000 requests for TEPSLF loan forgiveness since May 2018, and approved 1 percent of these requests, totaling about $26.9 million in loan forgiveness (see figure). Most denied requests (71 percent) were denied because the borrower had not submitted a PSLF application. Others were denied because the borrower had not yet made 120 qualifying payments (4 percent) or had no qualifying federal loans (3 percent).

Completed TEPSLF Requests as of May 2019

More than a year after Congress initially funded TEPSLF, some of Education's key online resources for borrowers do not include information on TEPSLF. Education reported that it has conducted a variety of PSLF and TEPSLF outreach activities such as emails to borrowers, social media posts, and new website content. However, Education does not require all federal loan servicers (who may serve borrowers interested in public service loan forgiveness) to include TEPSLF information on their websites. Further, Education's Online Help Tool for borrowers—which provides information on PSLF eligibility—does not include any information on TEPSLF. Requiring all loan servicers to include TEPSLF information on their websites and including TEPSLF information in its online tool for borrowers would increase the likelihood that borrowers are able to obtain the loan forgiveness for which they may qualify.

Why GAO Did This Study

In the context of high denial rates in the PSLF program, Congress appropriated $700 million in 2018 for a temporary expansion to the public service loan forgiveness program for certain borrowers who were not eligible for the original PSLF program. TEPSLF funds are available on a first-come, first-served basis. GAO was asked to review TEPSLF.

This report examines (1) the extent to which the process for obtaining TEPSLF is clear to borrowers, (2) what is known about loan forgiveness approvals and denials, and (3) the extent to which Education has conducted TEPSLF outreach. GAO analyzed data from the TEPSLF servicer on loan forgiveness requests from May 2018 through May 2019 (the most recent available at the time of our review); reviewed Education's guidance and instructions for the TEPSLF servicer; assessed Education's outreach activities; interviewed officials from Education, the TEPSLF servicer, and selected groups representing borrowers; and reviewed borrower complaints about TEPSLF submitted to Education.

Recommendations

GAO is making four recommendations, including that Education integrate the TEPSLF request into the PSLF application, require all loan servicers to include TEPSLF information on their websites, and include TEPSLF information in its PSLF Online Help Tool. Education agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Federal Student Aid | The Chief Operating Officer of the Office of Federal Student Aid should integrate the TEPSLF request into the PSLF application, for example, by including a checkbox on the PSLF application, to provide borrowers a more seamless way to request TEPSLF consideration. (Recommendation 1) |

Education agreed with this recommendation. To make the TEPSLF loan forgiveness process easier for borrowers, Education stated that it will integrate the TEPSLF request into the PSLF application as part of the improvements planned for the PSLF application under its new online interface for student borrowers. On April 15, 2020, Education published a notice in the Federal Register, seeking comments on its plans to consolidate the forms that borrowers must complete if they want to request either PSLF or TEPSLF loan forgiveness, so that borrowers would only need to submit a single form to obtain public service loan forgiveness. Education released a combined form in November 2020, called the Public Service Loan Forgiveness & Temporary Expanded PSLF Certification & Application form and reported that the new combined PSLF form serves as both the application for PSLF and TEPSLF and employment certification. This combined form means that borrowers would only need to submit a single request for public service loan forgiveness through either program. In addition, the combined form will streamline the TEPSLF loan forgiveness process and reduce confusion for borrowers.

|

| Office of Federal Student Aid | The Chief Operating Officer of the Office of Federal Student Aid should provide certain borrowers, for example, those who are denied TEPSLF for not having 120 qualifying payments, with more information about options available to contest TEPSLF decisions on the TEPSLF website and in their denial letters. (Recommendation 2) |

Education agreed with this recommendation. In March 2021, Education added language to the TEPSLF website and in June 2021, Education revised its standard denial letters to provide borrowers with more information on available options for contesting TEPSLF decisions, including adding information on the Federal Student Aid Ombudsmen Group and Education's internal complaint process. This additional information will better inform borrowers about options they have to contest their TEPSLF denial if they disagree with the decision.

|

| Office of Federal Student Aid | The Chief Operating Officer of the Office of Federal Student Aid should require all loan servicers to provide TEPSLF information on their websites. (Recommendation 3) |

Education agreed with this recommendation and stated that it will require all loan servicers to provide TEPSLF information on their websites within 120 days. In January 2020, FSA required all of its loan servicers to include information about the TEPSLF program on their websites. As of June 2020, all loan servicer's websites included information about the TEPSLF program. This should help increase awareness among borrowers who may be otherwise unaware of the TEPSLF opportunity that was designed to help them.

|

| Office of Federal Student Aid | The Chief Operating Officer of the Office of Federal Student Aid should include TEPSLF information in its PSLF Online Help Tool. (Recommendation 4) |

Education agreed with this recommendation, stating that it would include TEPSLF information in the PSLF Help Tool. As of December 2020, Education had integrated TEPSLF information into the online PSLF Help Tool. This should improve Education's outreach and help increase borrower awareness of the TEPSLF opportunity.

|