Science & Tech Spotlight: Blockchain & Distributed Ledger Technologies

Fast Facts

The technology that allows Bitcoin and other cryptocurrencies to function could profoundly change the way government and industry do business. Distributed ledger technology allows the secure transfer of digital assets without management by a central authority. Instead, participants share synchronized copies of a ledger that records assets and transactions. Changes are visible to all participants.

Questions remain about the technology, including where it may be most useful, how best to regulate it, and how to mitigate its use in illegal activities.

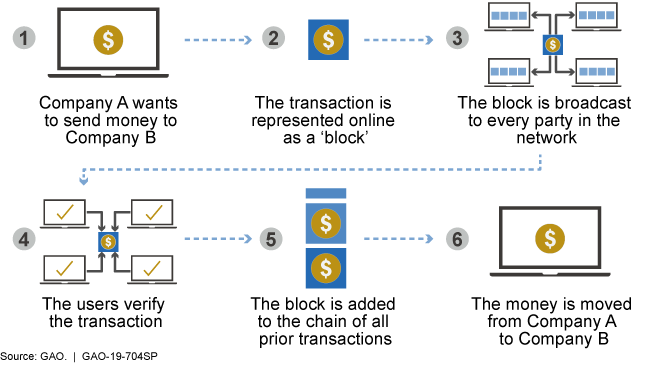

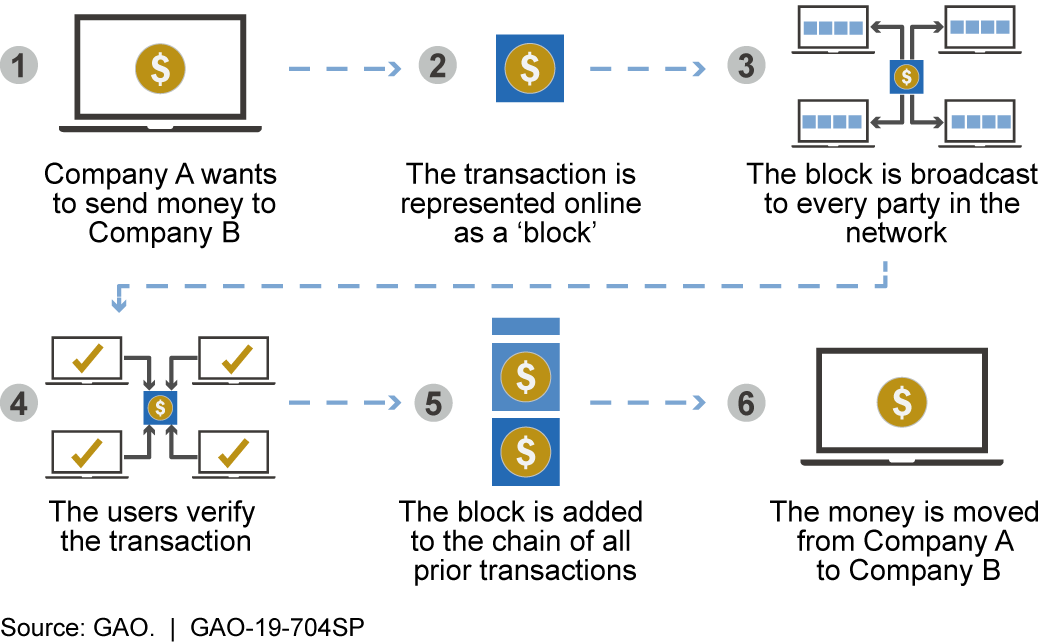

How blockchain, a form of distributed ledger technology, acts as a means of payment for cryptocurrencies.

Illustration showing the six steps for making payments using cryptocurrency

Highlights

The Technology

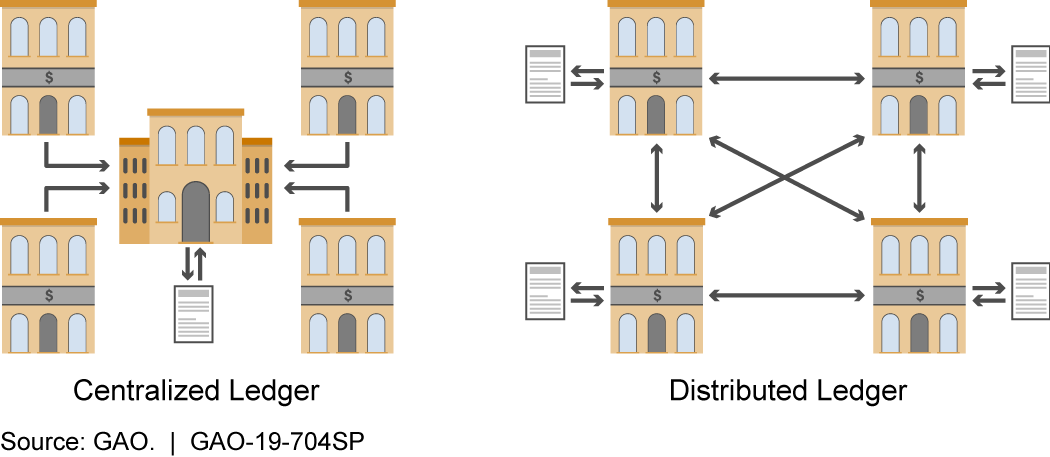

What is it? Distributed ledger technologies (DLT) like Blockchain are a secure way of conducting and recording transfers of digital assets without the need for a central authority. It is "distributed" because multiple participants in a computer network (individuals, businesses, etc.) share and synchronize copies of the ledger. New transactions are added in a manner that is cryptographically secured, permanent, and visible to all participants in near real time.

Figure 1. Difference between centralized and distributed ledgers.

How does it work? Distributed ledgers do not need a central, trusted authority because as transactions are added, they are verified using what is known as a consensus protocol. Blockchain, for example, ensures the ledger is valid because each "block" of transactions is cryptographically linked to the previous block so that any change would alert all other users. With an agreement on that history, users may then conduct a new transaction with a shared understanding of who has which resource.

Distributed ledgers can be either "permissioned" or "unpermissioned". With unpermissioned ledgers, which are generally public, any participant can conduct a transaction.Permissioned ledgers may or may not be public, but only trusted users can conduct transactions.

How mature is it? Businesses have been using ledgers to record transactions for thousands of years, and a defining characteristic of such ledgers was their reliance on central management. Furthermore, DLT is not a new technology, but an innovative way of using existing, mature technologies. In October 2008, an unknown author using the name Satoshi Nakamoto published a white paper called "Bitcoin – A Peer-to-Peer Electronic Cash System", which is credited as the first theoretical framework of a DLT. In January 2009 the service the paper described was launched.

Figure 2. How blockchain, a form of distributed ledger technology, acts as a means of payment for cryptocurrencies.

Cryptocurrencies like Bitcoin are a digital representation of value and represent the best-known use case for DLT. The regulatory and legal frameworks surrounding cryptocurrencies remain fragmented across countries, with some implicity or explicity banning them, and others allowing them.

In addition to cryptocurrencies, there are a number of other efforts underway to make use of DLT. For example, Hyperledger Fabric is a permissioned and private blockchain framework created by the Hyperledger consortium to help develop DLT for a variety of business applications. The consortium is made up of companies such as Airbus, Cisco, American Express, IBM, and Intel.

Opportunities

- Transparency. Because any user can view the ledger, DLT may result in benefits such as reduced corruption.

- Reduced Labor Costs. DLT reduce sor eliminates the need for human workers to track data.

- Data quality and reliability. Transaction information is automatically generated by a computer, which may reduce errors.

- Wide applicability. DLT is being explored for use across many sectors, including supply chain and logistics, news, energy, healthcare, and government. For example, Target built a system now known as ConsenSource to verify products are sourced sustainably. The New York Times created the News Provenance Project to explore a blockchain-based system for recording and sharing information published by news organizations.

Challenges

- Excessive energy usage. Some uses of DLT can be costly to operate. For example, cryptocurrencies using “proof-of-work” consensus protocols (also known as “mining”) require large amounts of computing power and energy to generate new units of currency.

- Collusion. Security of the network relies on the consensus protocol that maintains the ledger, and research has shown that users who collude could gain enough influence to manipulate the ledger to their benefit and gradually disrupt the protocol.

- Security. Entities using DLT will need to ensure data stored on a permissioned ledger is not accessible to outside actors. Additionally, holders of cryptocurrency can have their digital wallets hacked and their currency stolen.

- Permanence. While the permanence of transactions may be a core strength of DLT, it can also be a weakness should an entity find that it needs to regularly correct errors in its ledger, as it would be unable to easily do so with DLT.

- Lack of transparency. Because DLT can be used without a central authority, governments may feel uncomfortable allowing cryptocurrencies (or other DLT) to be used as a method of exchange or contracting, since they cannot easily be tracked and could be used to facilitate illicit activity (such as tax evasion and money laundering).

Figure 3. Permanence and lack of transparency and regulation raise concerns about adoptability.

- Lack of regulation. Businesses may express concern about making investments in DLT because of uncertainties surrounding how such technologies might be regulated. While there have been initial efforts to regulate cryptocurrencies such as Bitcoin, much less has been done around other DLT use cases.

Why This Matters

Distributed ledger technology (e.g. blockchain) allows users to carry out digital transactions without the need for a centralized authority. It could fundamentally change the way government and industry conduct business, but questions remain about how to mitigate fraud, money laundering, and excessive energy use.

Policy Context and Questions

DLT use across many sectors is increasing, but challenges remain to widespread adoption. Some key questions for consideration include:

- In what situations is DLT useful, and when should it be avoided or used with caution?

- To what extent can DLT be used to facilitiate illegal activities, and how might policymakers mitigate such use?

- How are federal agencies evaluating and using DLT?

For more information, contact Timothy M. Persons, Ph.D., Chief Scientist, at (202) 512-6412 or personst@gao.gov.