USDA Market Facilitation Program: Oversight of Future Supplemental Assistance to Farmers Could Be Improved

Fast Facts

USDA's Farm Service Agency (FSA) administered the Market Facilitation Program, which distributed payments to farms for losses caused by international trade disruptions in 2018 and 2019. FSA distributed $23 billion in such payments for those years.

We reviewed this program and found that FSA could have done better at ensuring these payments were accurate. For example, during its spot check on 2018 program payments, FSA should have paid special attention to risk factors including first-time recipients or farms that received program payments of over $250,000.

We recommended that FSA conduct more reliable reviews in the future.

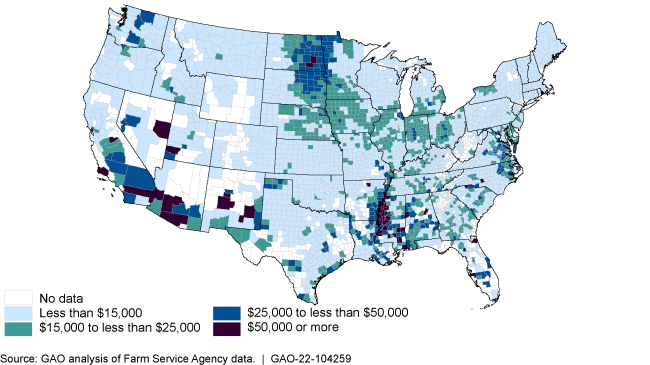

Average 2018 Market Facilitation Program Payments in the United States (per farm, by county)

Highlights

What GAO Found

Under the Market Facilitation Program (MFP) launched by the U.S. Department of Agriculture (USDA) for 2018 and 2019, USDA's Farm Service Agency (FSA) made payments totaling $23 billion to farms and farmers. GAO's analysis of FSA data found that historically underserved farmers—such as those belonging to socially disadvantaged groups that have been subject to racial, ethnic, or gender prejudice—received $818.9 million collectively (3.6 percent) in MFP payments (see table; data shown cannot be totaled across groups).

Payments to Farmers from Historically Underserved Groups by USDA's Market Facilitation Program (MFP)

|

Historically underserved group |

2018 MFP farmers (number) |

2018 MFP payments to farmers (dollars) |

2019 MFP farmers (number) |

2019 MFP payments to farmers (dollars) |

Total payments to farmers (dollars) |

|

Socially disadvantaged |

14,688 |

141,491,542 |

19,038 |

294,204,730 |

435,696,272 |

|

Military veterans |

6,664 |

91,287,315 |

7,418 |

149,293,571 |

240,580,886 |

|

Beginning to farm |

5,124 |

40,704,803 |

8,053 |

111,403,615 |

152,108,417 |

|

Limited resource |

538 |

1,436,917 |

995 |

4,478,125 |

5,915,042 |

Source: GAO analysis of Farm Service Agency data. | GAO-22-10425

Note: Some farmers belonged to more than one historically underserved group.

FSA also paid $163.4 million (0.7 percent) to 883 high-income farms and 1,164 farmers with adjusted gross incomes (AGI) over $900,000 per year. To be eligible for MFP payments, FSA required applicants to have average AGIs of $900,000 or less per year—unless they certified that at least 75 percent of their income was derived from farming, ranching, or forestry, in which case no income cap applied.

USDA agencies conducted several reviews of MFP payments to ensure they had gone to eligible applicants. However, FSA's review to verify that 2018 MFP payments were based on accurate information was limited in its usefulness for several reasons. For example:

- FSA did not ensure the results of its review were reliable because the agency did not collect or analyze information in a statistically valid manner.

- FSA reviewed a sample of larger payments at a higher rate than smaller payments but did not focus on other characteristics posing risk to the accuracy of payments, such as farms with which FSA lacked familiarity or historical data to corroborate eligibility.

- FSA did not communicate the results of its review, including a summary of findings and the types of errors found, or identify corrective actions.

FSA's guidance for the 2018 MFP review did not direct the agency to (1) ensure results were reliable using sound statistical methodologies; (2) take a more complete risk-based approach, as used for other FSA programs; or (3) communicate results and identify corrective actions. In addition, FSA discontinued its 2019 MFP compliance review because of competing agency priorities, including implementation of another supplemental assistance program. FSA would improve its oversight of payments and enhance the usefulness of future compliance reviews for supplemental assistance programs by developing better guidance for conducting such reviews.

Why GAO Did This Study

To offset losses in agricultural export sales caused by international trade disruptions and increased tariffs on certain U.S. exported products, FSA distributed payments to farms through the MFP, a USDA supplemental assistance program. Such programs aid eligible farms that have been affected by various situations or events, including financial hardship or crop damage and loss following natural disasters.

FSA collects demographic information from farmers who participate in programs such as the MFP, including whether they belong to historically underserved groups and their income levels .

GAO was asked to review aspects of USDA's implementation and oversight of the MFP. This report examines (1) USDA's distribution of MFP payments to historically underserved and high-income farmers for both 2018 and 2019 and (2) the extent to which USDA verified farms' compliance with MFP eligibility requirements for both 2018 and 2019.

GAO reviewed USDA documents and data and interviewed agency officials.

Recommendations

GAO is making four recommendations, including that FSA issue guidance for future compliance reviews of supplemental assistance programs to (1) design data collection and analysis in a way that ensures reliable results, (2) assess risk characteristics and take a more complete risk-based approach, and (3) communicate results and identify corrective actions. FSA generally agreed with the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Farm Service Agency | The Administrator of FSA should issue guidance directing the agency to design its data collection and analysis for future compliance reviews of supplemental assistance programs in a way that ensures reliable results by using sound statistical methodologies, defining objectives, identifying the information requirements to meet objectives, and processing data into quality information that achieves objectives. (Recommendation 1) |

In November 2023, FSA updated its guidance for compliance activities embedded within each individual program. FSA initiated a new process called the "Producer Compliance Audits," that ensures reliable results by using sound statistical methodologies, defining objectives, identifying the information requirements to meet objectives, and processing data into quality information that achieves objectives. The guidance was communicated to the FSA field staff on a program-by-program basis.

|

| Farm Service Agency |

Priority Rec.

The Administrator of FSA should issue guidance directing the agency to assess risk characteristics and take a more complete risk-based approach in selecting samples for future compliance reviews of supplemental assistance programs. This approach could include focusing on farming operations that received substantially large payments and new customers for which FSA does not have other information to corroborate eligibility for program participation. (Recommendation 2) |

In April 2024, FSA issued updated guidance on developing a risk-based approach for selecting samples for compliance reviews of its programs and added support for its field staff to identify and assess risk characteristics that may include payment eligibility as well as program eligibility.

|

| Farm Service Agency | The Administrator of FSA should issue guidance directing the agency to document the rationale for the tolerance level (e.g., the allowable percentage difference between farming operations' actual production and their claimed production) used in future compliance reviews of supplemental assistance programs. (Recommendation 3) |

In November 2023, FSA updated the variances allowed in established programs for certified production and acreage-based benefit programs, as well as acceptable documentation supporting certified ownership share of production for payment.

|

| Farm Service Agency | The Administrator of FSA should issue guidance directing the agency to communicate the results of its future compliance reviews of supplemental assistance programs, including a summary of findings and the types of errors found, and identify corrective actions to be taken. (Recommendation 4) |

In December 2023, FSA published a "Program Implementation Reference Guide " that provides information on monitoring compliance over FSA programs, such as spot checks by the FSA program managers to ensure the checks are completed accurately and in a timely manner. In addition, the guidance states that the results of the FSA program spot checks, which include recommendations or corrective actions, are to be communicated to FSA leadership.

|