Science & Tech Spotlight: Non-Fungible Tokens (NFTs)

Fast Facts

What's an NFT?

An NFT, or non-fungible token, is a digital certificate of ownership that represents a digital or physical asset. Currently, NFTs are used mainly for digital artwork. For example, an NFT for a digital collage sold for $69.3 million in March 2021.

Many NFT buyers want to resell NFTs for a profit and, while all investments are risky, NFTs might present additional risks because there isn't any statutory and regulatory framework that is explicitly applicable to them.

New uses for NFTs are emerging, and revenue from NFTs could exceed $130 billion by 2030. The federal workforce may need more expertise to help protect consumers.

Abstract NFT collage

Highlights

Why This Matters

Revenue from NFTs could exceed $130 billion by 2030, and NFTs could help advance the digital economy. However, despite media attention and celebrity endorsements, they are poorly understood, and the current market is subject to speculation and fraud. Also, lack of NFT expertise in the federal workforce makes it difficult to address statutory and regulatory challenges.

The Technology

What is it? A non-fungible token (NFT) is a digital identifier, similar to a certificate of ownership, that represents a digital or physical asset. In general, a non-fungible asset is unique and not interchangeable with others. An NFT, like an original painting, has its own unique value. By contrast, fungible assets are interchangeable, like dollar bills or units of a cryptocurrency.

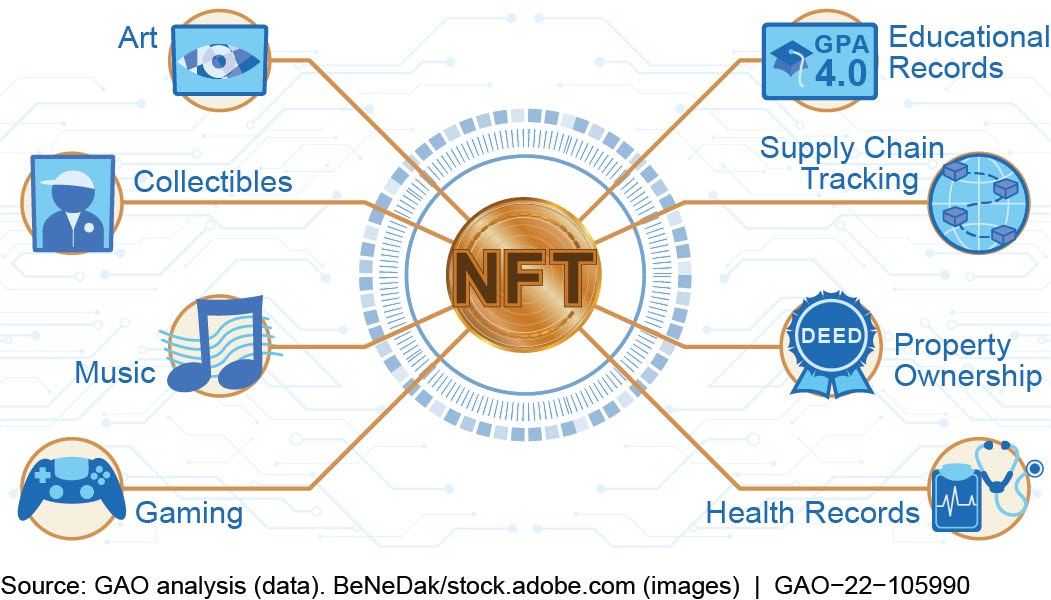

The most widespread use of the technology is currently for digital collectibles, like the NFT for a digital collage that sold for $69.3 million in March 2021. The use of NFTs for other applications is emerging (see fig. 1). For example, NFTs could enable a decentralized marketplace for music or other creative work, allowing creators to collect revenue for digital assets directly and automatically, rather than through a third party.

Figure 1. Examples of common and emerging digital and physical NFT applications.

How does it work? NFTs generally depend on the following technologies:

- A blockchain is a decentralized digital ledger that uses cryptography—such as encrypting the data—to enhance the security and permanence of transactions.

- An NFT marketplace is a website where one can create, sell, and buy NFTs—similar to other online platforms that allow users to conduct business with each other.

- A digital wallet is a contactless payment application that can store forms of payment, identification cards, NFTs, and more.

To create, or "mint," an NFT, the creator uploads a digital file, such as an image, photo, or piece of music, to a marketplace. The marketplace executes a code to create a unique identifier—the NFT—and adds it to a blockchain, which verifies, stores, and tracks it. Once created, the NFT can be sold, destroyed, or kept as a record indicating ownership. Typically, buyers purchase NFTs with digital currency, but legal tender, other assets, or credit could also be used.

Most NFTs are not the asset itself. In the case of a physical asset, they represent ownership of the asset. For digital assets, they represent ownership of the unique code linked to or associated with the asset's metadata—information about the asset, such as the creation date, size, or where it is stored on the internet. In the case of a digital image, others may be able to see the asset or even download a copy, but the NFT proves which digital image is the original and can, in conjunction with other information, show who owns the NFT.

NFTs rely on smart contracts—computer code that automatically executes a transaction when stipulated conditions are met. For example, a smart contract could stipulate that the original creator will receive a percentage of all subsequent sales of the NFT.

How mature is it? NFTs were first created in 2014 for digital images, but interest in them expanded in 2021. One company estimated that 360,000 people held 2.7 million NFTs between February and November 2021. According to a market research company, the NFT market size value was $50.1 billion in 2021 and could reach $130 billion or more by 2030, largely due to rising demand for decentralized marketplaces and digital collectibles.

Some scholars suggest that current NFT buyers are primarily interested in reselling NFTs for a profit. As with collectibles like first-edition books and sports cards, rarity and popularity can drive the value of collectible NFTs.

NFTs may also offer opportunities to a wider group of artists and creators. For example, they may help artists sell their work without relying on a third party, such as a gallery. The decentralized market can allow artists to fully profit from their art and interact directly with buyers all over the world. And it can allow buyers to support artists' free expression and autonomy.

Other NFT applications are emerging. For example, some researchers suggest that storing electronic health records as NFTs could give patients more control over who has access to their data and when or how to share it. One company is using NFTs to track and monitor consent for clinical trials. Individuals will be able to track and monitor their consent agreements in real time across different data sources. The company states this will give individuals control over their personal information and allow for flexibility to manage their consent. The company also believes that it will increase efficiency by reducing redundancy and the need for human involvement.

What are some concerns? Areas of concern with current NFT uses may affect public trust and could hinder their expansion into emerging areas. Some users of the technology have purchased collectible NFTs with the goal of making a profit, but, like other investments, NFTs come with financial risk and have exhibited volatile pricing. Cryptocurrency, which has fluctuated in value, is often used to purchase and set a value for NFTs and can exacerbate this volatility. NFTs are susceptible to artificial price influences, such as celebrity endorsements and illicit activities. For example, NFT owners can set up multiple digital wallets to sell NFTs to themselves, thereby inflating an NFT’s perceived value.

The federal government and private industry have also identified concerns that relate to NFTs. In March 2022, the President issued Executive Order 14,067 aimed at developing a whole-of-government approach to addressing the risks and harnessing the potential benefits of digital assets and their underlying technology. Additionally, in March 2022, the Department of Justice charged two people in an alleged $1 million fraud scheme after they promised an NFT collection to investors, then transferred all the money raised without making the collection available. At least one insurance company is considering options to cover fraud and other NFT-specific risks. Further, some governmental organizations are considering how to protect and inform consumers about NFT risks. In April 2022, the Joint Chiefs of Global Tax Enforcement released a bulletin on how to recognize money laundering and other illicit uses.

NFTs could also pose a risk to privacy. For example, without proper safeguards, the assets in an individual’s digital wallet may be publicly viewable, which could reveal identifiable information. Users could also receive unwanted or illicit NFTs, such as NFTs associated with obscene content, because some transactions do not require recipient approval.

Another concern is the federal government’s long-standing difficulty with hiring and retaining a highly qualified science and technology workforce. Some researchers suggest that sufficient expertise could help inform policymakers as they consider what actions, if any, are necessary to regulate NFTs.

Opportunities

- Decentralization. NFT creators and buyers can interact and set the terms of their transactions without third-party involvement, which could allow creators to keep a greater share of the profits.

- Digital economy. NFT applications may improve the efficiency of the digital economy. For example, they could facilitate the processing of records, help businesses attract startup funding, and help match fundraisers with donors.

Challenges

- Investment risk. Like other investments, NFTs come with financial risk and can have pricing volatility. In addition, when individuals purchase NFTs on the internet, they may not be warned about the risks as they would be for a traditional investment.

- Illicit activities. Criminals can take advantage of users through fraudulent activity to steal NFTs or the assets used to purchase them. Smart contracts may pose similar cybersecurity risks.

- Privacy. NFT information on distributed digital ledgers and in digital wallets may be publicly viewable and reveal personally identifiable information.

- Lack of federal expertise. NFTs are rapidly evolving. Many in the federal workforce may not understand current and emerging uses across different sectors, which could make it harder to identify and address statutory and legal challenges.

Policy Context and Questions

- What, if anything, might policymakers do to better protect individuals or entities using NFTs, including through the use of regulatory or criminal enforcement mechanisms?

- How could policymakers enhance the expertise of the federal workforce to address the use of NFTs and clarify the applicability of current statutory and regulatory frameworks to current and future NFT uses?

For more information, contact Karen Howard at 202-512-6888 or HowardK@gao.gov.