Federal Budget: Government-Wide Inventory of Accounts with Mandatory Spending, Fiscal Years 2001–2021

Fast Facts

"Mandatory spending" is the federal spending that isn't usually a part of the annual appropriations process.

The laws establishing mandatory spending programs set eligibility rules and payment formulas, which—along with factors such as changes in demographics or interest rates—drive annual costs.

We described trends in mandatory spending from fiscal years 2001-2021.

For example, more than 60% of annual federal spending during this period was mandatory spending. Most of this spending supported Social Security, Medicare, Medicaid, and net interest on the national debt. The federal response to COVID-19 increased mandatory spending in FYs 2020-21.

Highlights

What GAO Found

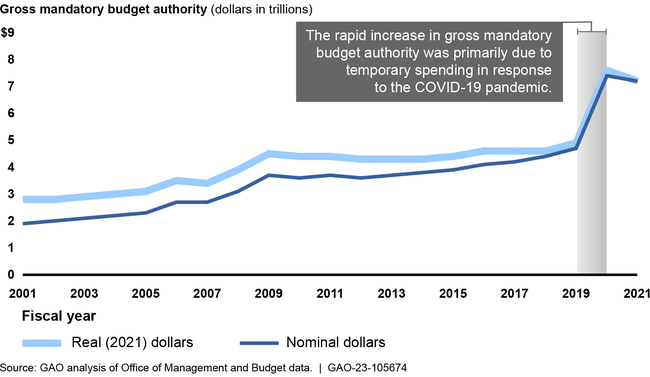

Mandatory spending refers to budget authority that is typically provided in laws other than appropriation acts. Mandatory budget authority grew from $1.9 trillion in fiscal year 2001 to $7.2 trillion in fiscal year 2021, an increase of 282 percent, or 160 percent adjusted for inflation in fiscal year 2021 dollars. As GAO has previously reported, demographic factors, rising health care costs, and legislative decisions have contributed to this increase in spending over time.

Government-Wide Gross Mandatory Budget Authority, Fiscal Years 2001–2021, in Nominal and 2021 Inflation-Adjusted Dollars

Note: GAO used the fiscal year 2021 gross domestic product price index to adjust for inflation.

From fiscal years 2001 through 2021, the 10 budget accounts with the largest amount of gross mandatory budget authority primarily supported Social Security, Medicare, Medicaid, and interest on the public debt. These 10 accounts represented 64 percent of government-wide mandatory budget authority during this time. In fiscal years 2020 and 2021, the federal COVID-19 response resulted in increases in mandatory spending in accounts funding other programs, such as Economic Impact Payments.

A budget account's fund type indicates, among other things, the source of funding for the account. From fiscal years 2001 through 2021, the majority of mandatory budget authority came from general fund accounts and non-revolving trust fund accounts.

- General fund accounts hold all federal money not allocated by law to any other fund account. This fund type supported programs such as Medicaid.

- Non-revolving trust fund accounts are designated as “trust funds” by law and used to track receipts and spending for programs that have specific taxes or other revenues dedicated by law for their use. In some cases, they receive payments from general fund accounts. This fund type supported programs such as Social Security and unemployment benefits.

Why GAO Did This Study

From fiscal years 2001 through 2021, more than 60 percent of federal spending in any given year came from mandatory spending. Generally, Congress and the President control spending for mandatory programs indirectly—by defining eligibility for these programs, and setting the programs' benefit or payment rules in the authorizing legislation—rather than directly through annual appropriations acts. As a result, mandatory spending may not undergo review as part of the annual appropriations process.

GAO was asked to review mandatory spending. This report describes trends among federal budget accounts with mandatory budget authority in fiscal years 2001-2021, among other things.

GAO analyzed Office of Management and Budget data to identify accounts with mandatory budget authority in fiscal years 2001-2021. GAO selected this time frame to provide historical context for federal spending, among other reasons.

To describe trends in mandatory spending, GAO analyzed gross mandatory budget authority data on accounts that comprised the top 99 percent of all gross mandatory budget authority in any fiscal year from 2001 through 2021. Gross mandatory budget authority refers to total mandatory budget authority before reduction by applicable offsets, such as fees members of the public pay to use national parks.

For more information, contact Jeff Arkin at (202) 512-6806 or ArkinJ@gao.gov.