Financial Services Industry: Overview of Representation of Minorities and Women and Practices to Promote Diversity

Fast Facts

We have issued several reports since 2017 reviewing the share of women and different racial/ethnic groups in the financial services industry, challenges associated with recruiting and retaining diverse staff, and practices to expand opportunities.

We testified about these reports and how the financial services industry is addressing challenges and expanding opportunities. For instance firms are:

- assessing data on the diversity of their employees

- conducting targeted recruitment to build a potential pipeline of diverse employees

- promoting interest in both STEM and financial services among women

Highlights

What GAO Found

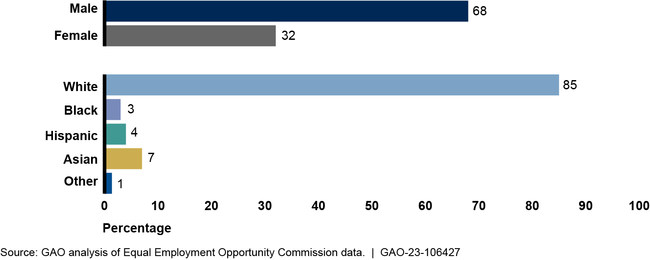

Equal Employment Opportunity Commission (EEOC) data that GAO analyzed on diversity in the financial services industry show slight increases in representation of minorities (racial/ethnic groups other than White) and women in management positions from 2007 to 2020. For instance, for senior management positions:

- EEOC data (for 2007–2015) showed that Asian representation increased from 4 to 5 percent. Black and Hispanic representation was about 3 percent. Female representation remained around 29 percent in that period.

- EEOC data (for 2018–2020) showed representation for both minorities and women was relatively flat or marginally increased. Black and Hispanic representation remained at about 3 and 4 percent, respectively. Female representation increased from 31 to 32 percent in that period.

Representatives of financial services firms and other stakeholders with whom GAO spoke for the November 2017 report (GAO-18-64) described challenges in recruiting and retaining members of minority groups and women. They also identified practices that could help address the challenges, including recruiting students from a broad group of schools and academic disciplines and establishing management-level accountability to achieve diversity goals.

Gender and Race/Ethnicity Representation of Executive/Senior-Level Management in the Financial Services Industry, 2020

Note: The “Other” category includes Native Hawaiian or Pacific Islander, Native American or Alaska Native, and “two or more races.”

GAO's more targeted work highlighted industry challenges in recruiting and retaining women and minorities and using the services of minority- and women-owned businesses. GAO examined diversity efforts of the Federal Home Loan Banks, Fannie Mae, and Freddie Mac. GAO also reviewed practices for selecting minority and women-owned asset managers and recruiting women with science, technology, engineering, and math degrees. Challenges included high levels of competition for diverse talent and bias in selecting service providers (preference for larger firms with brand recognition). Key practices to address these challenges included conducting targeted outreach and communicating diversity and inclusion priorities and goals within their organization.

Why GAO Did This Study

The financial services industry provides services that help families build wealth and is essential to the continued economic growth of the country. Research has found that a diverse workforce can help managers understand and address the needs of a demographically diverse customer base. Diversity also can be beneficial in solving complex problems and lead to better performance.

This statement is based on five GAO reports (GAO-21-490, GAO-20-637, GAO-19-589, GAO-18-64, GAO-17-726) on diversity efforts in the financial services industry and recent EEOC data. It discusses our work on (1) trends in management-level diversity in the financial services industry and (2) diversity and inclusion efforts by private and public financial services entities.

For this statement, GAO analyzed the most recent available EEOC data from 2018 through 2020 on workforce race, ethnicity, and gender in the financial services industry. For the prior work, GAO reviewed literature, documentation on diversity practices and policies, and EEOC data. GAO also interviewed representatives from federal agencies, financial services firms, and nonprofits.

For more information, contact Daniel Garcia-Diaz at (202) 512-8678 or GarciaDiazD@gao.gov.