Higher Education: Options That May Help Survivors of Sexual Violence Continue Their Education and Manage Federal Student Loans

Fast Facts

Sexual violence is traumatic for all survivors—and those in college may suffer academic and financial consequences.

We interviewed officials from 4 colleges and 8 organizations that represent survivors of sexual violence, student loan borrowers, and colleges. They said policies and practices like these can help students continue education after trauma:

mental health counseling or referrals

no-contact orders, campus escorts, and housing changes

leaves of absence, assignment extensions, and flexible grading

The Department of Education also has loan postponement and repayment options that can help survivors manage their federal student loans.

Highlights

What GAO Found

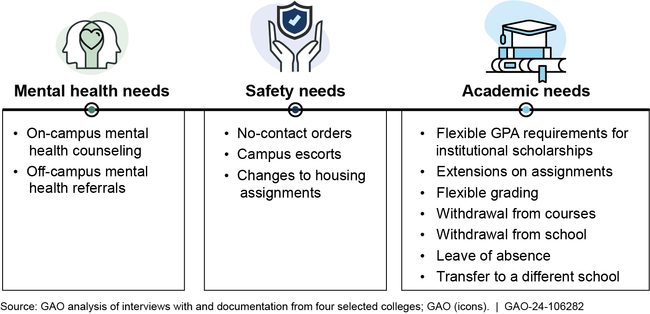

All four colleges GAO selected offered a mix of policies and practices to help address mental health, safety, and academic needs for survivors of domestic violence, dating violence, sexual assault, or stalking (see figure). Stakeholders GAO interviewed from the four colleges and eight organizations representing survivors, student loan borrowers, and colleges generally said these policies and practices can help survivors continue their college education.

- Mental health needs. All four colleges offered mental health services on campus or referrals to services off campus. Several stakeholders cited the importance of addressing survivors' mental health needs.

- Safety needs. All four colleges offered protective measures, such as no-contact orders and housing changes, to help survivors manage their interactions. Most stakeholders identified safety needs as a priority.

- Academic needs. All four colleges offered adjustments to courses, leaves of absence or withdrawals, and flexible transfer policies, which most stakeholders said can help survivors continue their education.

Examples of Policies and Practices to Help Survivors Continue Their College Education

The Department of Education has several loan postponement and repayment options that can help survivors—and borrowers generally—manage their federal student loans. Eligible survivors can postpone making payments on their loans during the 6-month grace period after leaving college or dropping below half time, as well as during authorized deferment and forbearance periods. Borrowers may be able to reduce their monthly payments by enrolling in an Income-Driven Repayment (IDR) plan, which bases monthly payments on income and family size. Most stakeholders said that survivors could benefit from existing loan postponement and repayment options. GAO found each of the four loan servicers had procedures for guiding borrowers through them. Education and loan servicers said they prioritize IDR plans as a long-term solution for borrowers struggling to make payments. Payments on IDR plans may be as low as $0 and count toward potential loan forgiveness at the end of the repayment period.

Why GAO Did This Study

According to research, domestic violence, dating violence, sexual assault, and stalking can have significant consequences on survivors. Survivors who were enrolled in college when the trauma occurred may experience both academic and financial consequences. The Consolidated Appropriations Act, 2022, includes a provision for GAO to review issues related to the impact of domestic violence, dating violence, sexual assault, or stalking on survivors' ability to continue their education and repay their federal student loans.

This report describes (1) policies and practices selected colleges have to help survivors continue their education and (2) repayment options that can help eligible survivors manage their federal student loans.

GAO reviewed documentation from Education and its loan servicers. GAO selected four colleges based on size (small, mid-size, and large), sector (public, private not-for-profit, private for-profit), program length (2-year and 4-year), and other factors. GAO also interviewed Education officials and 12 stakeholders, including administrators from the four colleges and representatives from eight organizations representing survivors, student loan borrowers, and colleges. GAO also reviewed relevant federal laws and regulations.

For more information, contact Melissa Emrey-Arras at (617) 788-0534 or emreyarrasm@gao.gov.