Improper Payments and Fraud: How They Are Related but Different

Fast Facts

It's estimated that improper payments and fraud have collectively cost taxpayers trillions of dollars and affect the integrity of many federal programs. Improper payments are payments that shouldn't have been made or that were made in the wrong amount.

This Q&A report looks at the distinct but related concepts of improper payments and fraud and why they occur. For example, fraud may be the reason why improper payments have been made. But fraud doesn't necessarily have to involve payments—e.g., passport fraud.

We identify resources that can help agencies prevent improper payments and fraud. We also discuss relevant recommendations we've made.

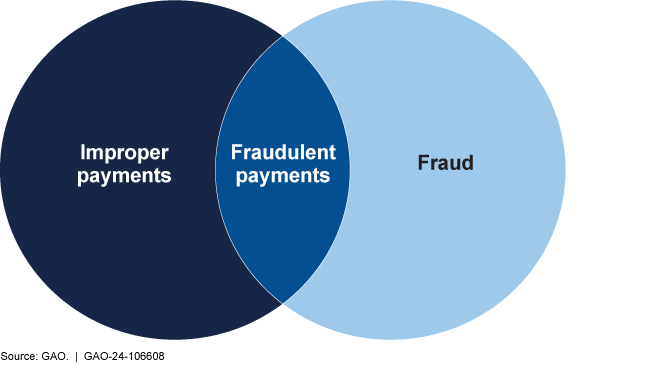

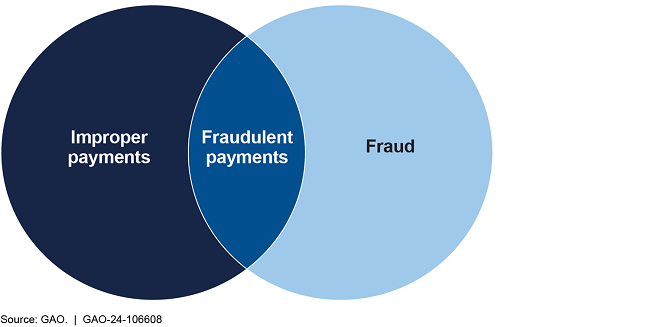

Some—but not all—improper payments are also fraudulent

Highlights

What GAO Found

Improper payments are any payments that should not have been made or that were made in an incorrect amount. Fraud involves obtaining a thing of value through willful misrepresentation. Improper payments and fraud involving federal funds are two distinct concepts that are related, but not interchangeable. For example, while all fraudulent payments are considered improper, not all improper payments are due to fraud. Similarly, there are types of fraudulent activity that do not result in improper payments (i.e., nonfinancial fraud).

Figure: Relationship between Improper Payments and Fraud

The Payment Integrity Information Act of 2019 contains requirements for managing improper payments and fraud. Requirements for agencies to manage improper payments include identifying risks, taking corrective actions, and estimating and reporting on improper payments. The improper payment estimation process is not designed to detect or measure the amount of fraud that may exist. The act's requirements related to fraud generally involve implementing control activities to prevent, detect, and respond to fraud.

GAO has developed several resources to help agencies combat improper payments, including those related to fraud. These resources include guidance such as A Framework for Managing Improper Payments in Emergency Assistance Programs, A Framework for Managing Fraud Risks in Federal Programs, and the web-based Antifraud Resource. These resources can help agencies better understand and combat the causes and impacts of improper payments and fraud.

GAO has previously reported on features of corrective actions that agencies have taken to reduce improper payment rates, such as establishing accountability, facilitating collaboration, and providing technology, tools, and training. These actions can help identify improper payments that are due to errors and can further support existing or future antifraud fraud controls designed specifically to prevent, detect, and respond to fraud. For example, improper payment corrective actions that focus on accountability, collaboration, and tools and training can also help combat fraud-related improper payments. GAO has also reported previously on existing challenges that can limit agencies' abilities to use data to manage improper payments and fraud.

Why GAO Did This Study

Both improper payments and fraud result in significant financial and nonfinancial impacts to the integrity of federal programs. They erode public trust in government, waste taxpayer dollars, and hinder agencies' efforts to execute their missions and program objectives effectively and efficiently. Understanding the relationships and distinctions between improper payments and fraud is important to more effectively address the associated root causes and mitigate the impacts of each.

House Report 117-389, which accompanied the Legislative Branch Appropriations Act, 2023, includes a provision for GAO to provide quarterly reports on its ongoing oversight of improper payments.

This fourth quarterly report provides information on the relationships and distinctions between improper payments and fraud. This report also describes relevant GAO and other federal guidance and executive agency efforts since 2015 to manage and reduce the related causes and impacts of improper payments and fraud. GAO reviewed relevant federal statutes, standards, guidance, as well as reports from GAO and other federal agencies that focused on the management of, or distinctions and relationships between, improper payments and fraud.

Recommendations

Since 2015, GAO has made over 40 recommendations for agencies to use data analytical capabilities to help manage fraud risk, such as to verify self-reported data and identify fraud-related improper payments. More than half of these recommendations had not been fully implemented as of August 2023. GAO also recommended that Congress accelerate and make permanent the requirement for the Social Security Administration (SSA) to share its full death data with the Department of the Treasury's Do Not Pay system. Congress required SSA to share this data in 2020 in response to GAO's 2016 recommendation, but this requirement was only for a 3-year period. Treasury officials have informed GAO that by the end of this calendar year, the Do Not Pay working system should have full access to the full death data. However, under current law, that access will end in 2026. Implementing these recommendations can help agencies address the challenges of fraud-related improper payments, save taxpayer dollars, and better accomplish their missions and objectives.