The Nation's Fiscal Health: Road Map Needed to Address Projected Unsustainable Debt Levels

Fast Facts

The federal government faces an unsustainable long-term fiscal path that poses serious economic, security, and social challenges if not addressed. Our review of the nation's fiscal health found:

Debt is projected to grow faster than the economy, reaching 200% of GDP by 2050 if revenue and spending policies are unchanged

Large budget deficits drive the growing debt, as Medicare and Social Security spending outpace revenue

Government interest spending as a share of GDP will reach an all-time high by 2030, in part due to rising interest rates

We suggested developing a plan for fiscal sustainability and identified pieces of an effective plan.

Highlights

What GAO Found

The federal government faces an unsustainable long-term fiscal path that poses serious economic, security, and social challenges if not addressed. Congress and the administration will need to make difficult budgetary and policy decisions to address the key drivers of federal debt and change the government's fiscal path. The sooner actions are taken to change the long-term fiscal path, the less drastic they will need to be.

Debt is Projected to Grow Faster than the Economy Over the Long Term

At the end of fiscal year 2023, the $26.2 trillion in debt held by the public was about 97 percent of gross domestic product (GDP). GAO projects that under current revenue and spending policies, debt held by the public will

- reach its historical high of 106 percent of GDP by 2028, and

- grow more than twice as fast as the economy over a 30-year period, reaching 200 percent of GDP by 2050.

Perpetually rising debt as a share of GDP is unsustainable and has many direct and indirect implications on the economy and American households and individuals.

Debt Held by the Public Projected to Grow Faster Than GDP

Debt Levels Driven by Increasingly Large Annual Deficits

When the government spends more than it collects in revenue, it borrows to finance the resulting deficit by issuing debt to the public. Despite strong economic growth, the fiscal year 2023 deficit was $1.7 trillion, the fourth year in a row of a deficit above $1 trillion.

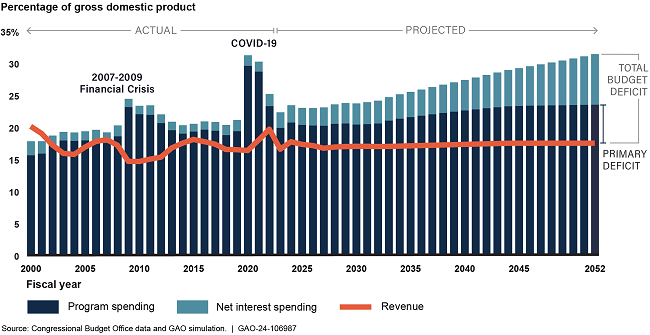

The deficit is composed of two parts.

- The primary deficit—the gap between program spending and revenue—which was about $1 trillion in fiscal year 2023.

- Net interest spending—primarily the cost to service the debt—which was $659 billion in fiscal year 2023.

Primary Deficit and Total Budget Deficit, Actual and Projected

Primary deficits are projected to grow over the long term, in large part because of projected increases in spending for Medicare, other federal health care, and Social Security programs compared to relatively lower projected increases in revenue.

Persistent and widening primary budget deficits signal a structural imbalance between revenue and spending. Policymakers have more control over primary deficits because program spending and revenue reflect policy decisions, whereas net interest spending reflects the consequences of prior policy decisions.

Higher Interest Rates Contribute to Increased Net Interest Spending

In fiscal year 2023, federal net interest spending—primarily interest on debt held by the public—increased 39 percent from fiscal year 2022 (from $475 billion to $659 billion). We project the federal government will pay more than $1 trillion in net interest costs every year starting in 2029. The recent rise in net interest spending has been driven, in part, by higher interest rates.

Growing debt levels combined with higher interest rates lead to projected increases in the government's net interest spending as a share of GDP. Net interest spending averaged 1.5 percent as a share of GDP over the last 20 years even as the debt grew, primarily because interest rates were historically low. GAO projects that net interest spending will reach the historical high of 3.2 percent of GDP in 2030 and grows to 7.9 percent of GDP in 2052. Increases in interest spending will add to future debt because the government will need to borrow more to pay for increased interest costs.

A Plan Is Needed to Change the Unsustainable Fiscal Path

GAO has previously suggested that Congress develop a plan to address the government's unsustainable fiscal path. A sustainable fiscal policy would lead to debt held by the public growing at the same—or slower—rate than the economy.

GAO’s work has identified several components of an effective fiscal plan:

- Incorporate well-designed fiscal rules and targets to help manage debt, for example by controlling factors such as spending and revenue to meet a debt-to-GDP target.

- Consider alternative approaches to the current debt limit

- Assess the drivers of the primary deficit, such as mandatory and discretionary spending and revenue.

- Address financing gaps for Medicare and Social Security, both of which are supported by trust funds that are projected to be depleted within 10 years.

- Pursue opportunities to improve fiscal responsibility that do not require major changes to spending and revenue policies.

Why GAO Did This Study

GAO produces this annual fiscal health report to examine the current fiscal condition of the federal government and its future fiscal path, absent policy changes in revenue and program spending. The report is based on the results of GAO's fiscal simulation using information available as of September 30, 2023 (the end of fiscal year 2023).

This report describes: (1) trends in federal debt; (2) trends in primary deficits, the gap between program spending and revenue; (3) trends in net interest spending; and (4) components of a sustainable long-term fiscal plan.

For more information, contact Jeff Arkin, Director at arkinj@gao.gov or (202) 512-6806.