Tax Enforcement: IRS Can Improve Use of Information Returns to Enhance Compliance

Fast Facts

Employers, banks, and other third-parties file "information returns" with the IRS detailing your income and other factors that can affect your tax bill. Mismatches between this information and what you report on your taxes can indicate errors or fraud.

This Snapshot report covers our work on tax information reporting and how IRS could, for example:

Improve its use of information returns

Lay the groundwork to potentially expand information reporting

Evaluate the process to improve tax law compliance and reduce taxpayer burden

Analyze and improve existing forms for information returns to make them more useful for tax enforcement and more

Highlights

The billions of W-2s and other information returns that IRS receives are key to ensuring that taxpayers correctly pay their taxes. In prior reports, we’ve recommended ways for IRS to improve how it uses these returns to ease the burden on taxpayers and ensure they pay their taxes.

The Big Picture

The Internal Revenue Service (IRS) received more than 5 billion W-2s and other “information returns” in 2022. These forms are a vital component of the U.S. tax system.

Information returns are filed by third parties (e.g., employers, businesses, banks). Examples include Form W-2 for employee wages, 1099-NEC for nonemployee compensation (such as gig economy work), and 1099-K for payment card and third-party settlement organizations—intermediaries between buyers and sellers of goods or services (e.g., Uber, Venmo, and eBay).

Volume of Information Returns, 2022

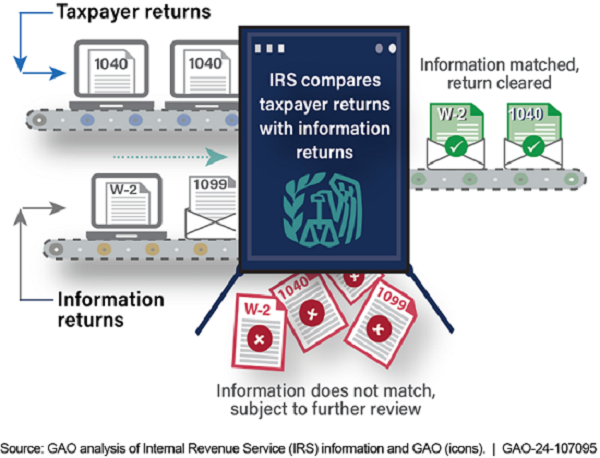

Taxpayers can use information returns to complete their tax returns. IRS uses them to verify self-reported income and tax on returns filed by taxpayers.

Overview of IRS's Process for Matching Information Returns

Not all income is reported on information returns. When there is little or no third-party information reporting, taxpayers report their incomes incorrectly about 50 percent of the time. For example, there are gaps in information reporting on rental real estate income. We have found that half of taxpayers with such income did not accurately report their income and expenses on their tax returns.

What GAO’s Work Shows

IRS Lacks Centralized Leadership to Make Strategic Decisions about Information Returns

IRS compliance programs use information returns to help identify potential fraud and noncompliance, and taxpayers who fail to file tax returns but should have.

Examples of IRS Compliance Programs that Use Information Returns and Associated Tax Assessments, Fiscal Year 2022

|

Program |

Cases closed |

Dollar value |

|---|---|---|

|

Automated Underreporter: Identify potential underreported income or unwarranted deductions |

1,582,131 |

$8.7 billion |

|

Automated Substitute for Return: Estimate tax liability when taxpayers do not file returns |

295,577 |

$2.9 billion |

Source: GAO analysis of Internal Revenue Service (IRS) information. | GAO-24-107095

However, IRS lacks centralized leadership to make strategic decisions related to the use of information returns across the agency. For example, IRS has not analyzed information returns comprehensively to determine if the returns' characteristics (e.g., deadlines) meet IRS's needs. While information returns support multiple IRS compliance programs, no office is responsible for coordinating these efforts.

New Form 1099-K Reporting Threshold May Exacerbate Taxpayer Confusion

The American Rescue Plan Act of 2021 lowered the reporting threshold for Form 1099-K. Previously, reporting was required if a taxpayer had annual payments of $20,000 and 200 transactions. Beginning in 2023, reporting is required if a taxpayer has total annual payments exceeding $600.

Many taxpayers will receive Form 1099-Ks who did not in the past, which may help some taxpayers comply. But, despite IRS communication efforts, it also may exacerbate confusion among some taxpayers, such as gig workers, who may not understand the taxability of their payments and taxes owed. For example, some of these taxpayers may not know how to calculate profit or loss and may not understand the information reported on the form. This puts them at risk of inaccurately reporting their incomes to IRS or not meeting their tax obligations.

IRS expects to receive about 44 million Form 1099-Ks in 2024—an increase of about 30 million. However, this estimate may change as IRS receives more information from large filers and states. IRS does not have a plan to analyze these data to inform enforcement and outreach priorities. This limits its understanding of changes in taxpayer burden.

Challenges and Opportunities

IRS's information reporting system is an extensive network with complex requirements that facilitates compliance checks on tax returns. To that end, it is important that IRS balance information collection with reporting burden to effectively enhance compliance and help taxpayers understand their responsibilities.

IRS plans to build a unified compliance organization that enhances planning and strategy and has taken steps to improve its use of information returns, including developing a platform that will help IRS modernize the electronic intake and processing of these forms. However, it is important that IRS implement our recommendations to:

- develop a collaborative mechanism to coordinate among the internal information return stakeholders, as well as to improve outreach to external stakeholders;

- research and develop potential recommendations to expand third-party information reporting on sole proprietor s ' income and expenses;

- develop a plan to systematically evaluate information returns to improve compliance, and reduce fraud and reporting burden;

- work to determine the most appropriate thresholds for payment information reporting , including Form 1099-K; and

- analyze existing and forthcoming 1099-K data to better understand and gain insights into noncompliance and taxpayer burden to make enforcement and outreach decisions.

We also have recommended that Congress consider:

- requiring all taxpayers with rental real estate activity to be subject to the same information reporting requirements as other taxpayers operating a trade or business.

For more information, contact James R. McTigue, Jr., at (202) 512-6806 or McTigueJ@gao.gov.