GAOverview: Understanding Waste in Federal Programs

Fast Facts

In this "GAOverview," we discuss types of waste in federal programs and strategies to address it.

Waste is when individuals or organizations spend government resources carelessly, extravagantly, or without purpose. Federal programs may be vulnerable to waste for a number of reasons, including asset mismanagement.

For instance, it can be difficult to track the purchase and use of goods and services at an agency, which can lead to waste. Implementing inventory management tools can better ensure that agencies are making the best use of their budgets and assets.

Highlights

Why This Matters

This GAOverview is part of a series aimed at helping officials better prevent and detect fraud, waste, and abuse. Wasteful spending reduces the efficiency and effectiveness of a wide range of federal programs and operations. Many examples of waste have been identified that relate to government purchases, but waste can also occur throughout other government operations. Waste can cost the federal government billions of taxpayer dollars due to mismanagement of assets, not following policies and statutes, or inadequate oversight procedures. Understanding potential causes of waste can help federal officials better identify and combat waste within their programs and operations.

What Is Waste?

Waste occurs when individuals or organizations expend government resources carelessly, extravagantly, or without adequate purpose. Waste involves incurring unnecessary costs due to inefficient or ineffective practices, systems, or controls. It can result in substantial losses to the federal government, as well as diverting the availability of funds for other purposes. Waste is sometimes discussed alongside fraud and abuse, all of which are significant issues for the federal government. Fraud involves obtaining something of value through willful misrepresentation as determined through the judicial or other adjudicative system. In contrast, waste and abuse do not necessarily involve violations of law. However, the discovery of waste during program audits, for instance, could indicate noncompliance with regulations or the potential for fraud.

What Are Some Potential Causes of Waste?

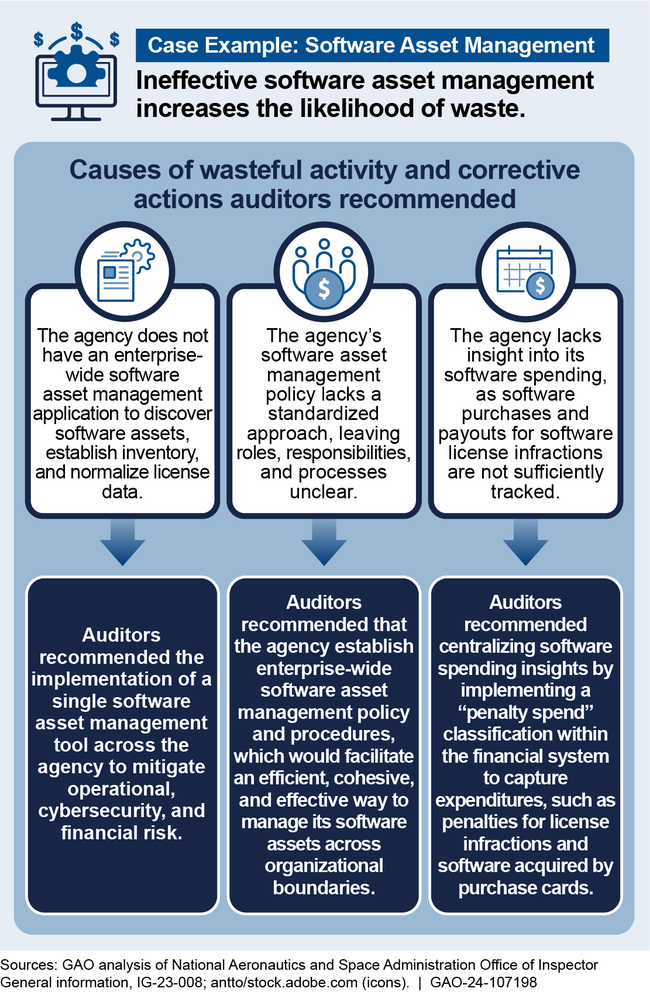

Programs may be vulnerable to waste due to mismanagement of assets. Inventory system shortcomings can result in problems with tracking the purchase and use of goods and services, making it difficult to control costs and leading to waste. Poor or nonexistent tracking hinders an agency’s ability to know what it has already purchased. For example, an agency unnecessarily spent more than $35 million on software fines and unused licenses over several years due to lack of insight into its prior purchases of licenses and how often they were used.

Personnel may engage in wasteful practices by not following policies and statutes. Senior officials could disregard policies and statutes as they apply to hiring. This can result in the hiring of ineligible employees. We identified instances where senior officials bypassed competitive hiring processes by appointing individuals, including a relative, to federal positions without proper regard for their qualifications. For example, an agency made salary payments to ineligible employees totaling nearly $440,000 before the employees were removed. These funds were wasteful because the hiring laws put in place to safeguard taxpayer dollars were not followed. These funds were wasteful because the hiring laws put in place to safeguard taxpayer dollars were not followed.

Program officials do not always establish adequate oversight procedures. Without establishing clear program goals, along with performance measures to ensure goals are being met, management increases chances of wasted resources. Lack of monitoring and oversight procedures, or failure to conduct quality control, could lead to inadequate planning and execution that can decrease a program’s ability to minimize waste. For example, one Inspector General identified up to $11.5 million in waste and associated safety hazards resulting from a lack of oversight to ensure that safety contract requirements for buildings were followed.

What Could Help Better Prevent Waste?

Improve asset management capabilities. Developing control activities over software purchases can improve asset management and reduce wasteful spending. For instance, agencies that implement software asset management tools can better ensure that they are accurately tracking software inventory to identify duplicative or obsolete software. They can also better ensure that the agency reduces the risk of procuring software in a costly and ineffective manner by minimizing licensing penalties and overspending. One agency has reported financial benefits of nearly $2.4 billion through the identification of unrecorded assets after improved operations and business processes. The figure shows how waste may occur and possible corrective actions.

Ensure that officials know and adhere to policies and statutes. Ensuring that agency officials know and follow established rules can help prevent waste. For example, an agency’s officials did not ensure that they clearly understood and adhered to federal hiring regulations and avoided prohibited personnel practices. Management should lead by an example that reflects the integrity and ethical values expected throughout the entity.

Develop adequate oversight procedures. Internal control is a dynamic process that should be adapted continually to the risks and changes an entity faces. Developing strong oversight procedures of program activities, such as ensuring requirements are met, can help program managers establish realistic goals and take corrective action, when necessary, to minimize waste. In addition, management should periodically review policies and procedures related to control activities for continued relevance and effectiveness in achieving objectives.

For more information, contact Seto Bagdoyan at (202) 512-6722 or bagdoyans@gao.gov.