Federal Financial Management: Substantial Progress Made since Enactment of the 1990 CFO Act; Refinements Would Yield Added Benefits

Fast Facts

Since the Chief Financial Officers Act was enacted nearly 30 years ago, the federal government has made significant progress in reforming and improving its financial management.

Among other things, the CFO Act and subsequent reforms have:

Modernized financial management leadership structures and systems

Helped prevent billions of dollars from being lost due to fraud, waste, abuse, and mismanagement

Improved the accuracy, reliability, and transparency of government financial reporting practices

We recommended Congress consider legislation addressing eight areas to further improve federal financial management.

Highlights

What GAO Found

Since enactment of the Chief Financial Officers Act of 1990 (CFO Act), the federal government has significantly improved its financial management, though challenges remain.

Progress Made in Federal Financial Management since the CFO Act

Leadership

- Centralized leadership structures were established—Deputy Director for Management and Controller positions and chief financial officers (CFO).

- Office of Management and Budget (OMB) prepared government-wide plans, issued guidance, and directed financial management activities.

- Department of the Treasury (Treasury) issued financial reporting guidance and a 10-year vision for federal financial management.

- CFO Council undertook initiatives to address government-wide financial management issues.

- Inspectors general recommended improvements in government operations and prevented and detected fraud, waste, and abuse.

Financial reporting

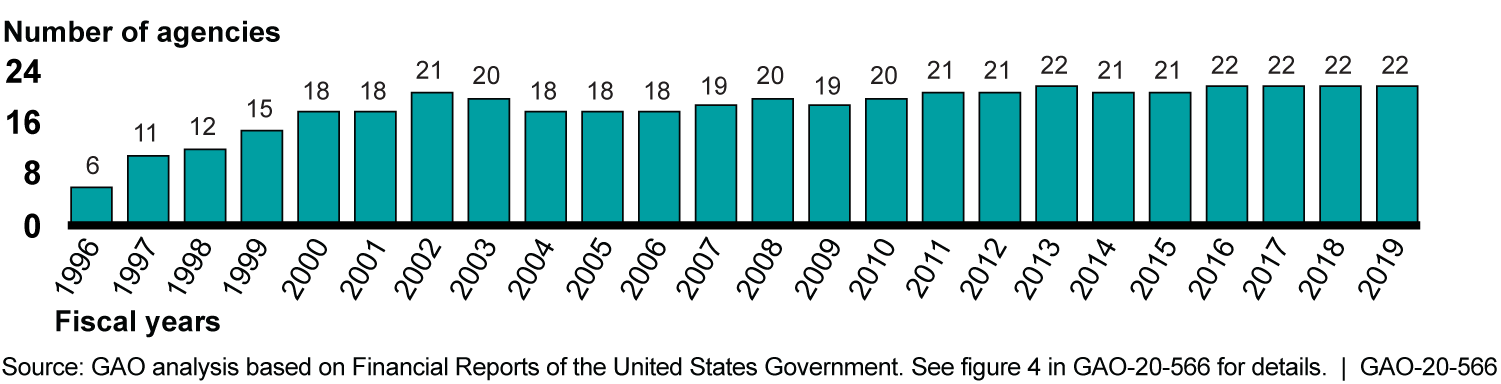

- Agencies’ audited financial statements improved accountability (see figure).

- Since fiscal year 1997, Treasury, in coordination with OMB, annually prepared consolidated financial statements for the U.S. government.

- Federal Accounting Standards Advisory Board issued 58 standards.

Number of Unmodified (“Clean”) Audit Opinions for Chief Financial Officers Act of 1990 Agencies for Fiscal Years 1996 through 2019

Internal control

- CFO Act agencies significantly improved their internal controls, increasing the reliability of their financial information.

- Treasury and OMB made significant progress in improving controls related to the consolidated financial statements of the U.S. government.

- Annual audits identified the significance of improper payments and information security weaknesses.

Financial management systems

- CFO Act agencies took steps to improve financial management systems and use government-wide providers for certain agency functions (e.g., payroll).

Financial management workforce

- Office of Personnel Management periodically updated key standards.

Challenges That Remain in Federal Financial Management

Leadership

- CFOs would benefit from standardized financial management responsibilities to provide them with the necessary authorities to achieve the full potential of the CFO Act.

- Deputy CFO positions would be strengthened by defined financial management responsibilities consistent with the breadth of those of the agency CFO. With frequent CFO turnover and a potentially lengthy vacancy period, long-term planning and leadership continuity can be affected.

- Government-wide financial management plans, prepared every 4 years, would help to address long-standing, costly, and challenging concerns in a strategic, comprehensive, and cost-effective manner. Annual government-wide plans, required by the CFO Act, were last prepared by OMB for fiscal year 2009.

Financial reporting

- Improving the linking of agency performance and cost information would help policymakers and managers make fully informed decisions.

- Agencies currently have limited financial management performance-based metrics to help them assess the quality of their financial management.

- Agencies may not have key financial management information needed for decision-making, such as for grants management. Without identifying and, if necessary, developing this information, the government cannot adequately ensure accountability or manage for results.

Internal control

- Agencies may not have reasonable assurance that key financial management information is reliable. Without separately assessing and reporting on the effectiveness of internal controls over financial reporting and other key financial management information and independent audit testing, management lacks reasonable assurance of the reliability of such information.

- Opportunities exist to address government-wide improper payments, which were estimated at about $175 billion for fiscal year 2019.

- Material weaknesses continue to prevent an audit opinion on the U.S. government’s consolidated financial statements.

Financial management systems

- Opportunities exist for improving financial management systems to reduce frequent failures or cost overruns and lengthy delays in deployment, and increase compliance with systems requirements.

- Some agencies rely on legacy systems that use outdated languages, are costly to maintain, and may not report reliable information.

- The widespread adoption of shared services—government-wide providers handling certain agency functions—faces challenges, thereby limiting cost savings.

Financial management workforce

- Comprehensive planning could help agencies build a federal financial management workforce that can adapt to modern needs and close skills gaps.

Why GAO Did This Study

Prior to enactment of the CFO Act, federal agencies lost billions of dollars through fraud, waste, abuse, or mismanagement. The CFO Act was enacted, in part, to address these problems—calling for comprehensive federal financial management reform. Among other things, the act established CFO positions, provided for long-range planning, and began the process of auditing federal agency financial statements. The act also called for integrating accounting and financial management systems, and systematic performance measurement and cost information.

GAO was asked to review federal financial management since the CFO Act. This report discusses (1) progress the federal government has made in achieving the purposes of the CFO Act and improving federal financial management and (2) remaining challenges for the federal government in achieving effective government-wide financial management.

GAO reviewed relevant laws, guidance, and reports; conducted interviews of current and former federal financial management officials; held a discussion group with former CFOs and a panel discussion with experts in federal financial management; and conducted surveys of CFOs, inspectors general, and independent public accountants.

Recommendations

GAO is identifying eight matters for congressional consideration, including that Congress consider legislation to require

- CFOs at the CFO Act agencies to have the responsibilities necessary to effectively carry out federal financial management activities;

- deputy CFOs at the CFO Act agencies to have defined responsibilities consistent with the breadth of those of the agency CFO;

- preparation of government-wide and agency-level 4-year financial management plans, including actions to improve financial management systems, strengthen the federal financial management workforce, and better link performance and cost information for decision-making, as well as an annual financial management status report;

- preparation of comprehensive financial management performance-based metrics and reporting of executive agencies’ performance against the metrics; and

- identification and, if necessary, development of key financial management information needed for effective financial management and decision-making as well as annual assessments and reporting by management on the effectiveness of internal control over the information and auditor testing and reporting on internal control over the information.

Treasury and OPM provided technical comments on the draft report. In its oral comments, OMB stated that it appreciated the incorporation of its views into the draft report and reemphasized its concerns relating to two matters for congressional consideration—a government-wide 4-year financial management plan and an annual status report and agencies assessing and reporting on the effectiveness of internal controls over key financial management information. GAO continues to believe that these measures would improve federal financial management.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider legislation to require each CFO at a CFO Act agency to oversee and provide leadership for all of the responsibilities necessary to effectively carry out federal financial management activities, including the formulation and financial execution of the budget, planning and performance, risk management, internal control, financial systems, and accounting. (Matter for Consideration 1) | The Improving Federal Financial Management Act (S.4700) was introduced in the 118th Congress and reported to the Senate floor, but no further action was taken. The language in this bill was substantively identical to the bill (HR.7164) introduced in the 117th Congress and substantially similar to the language used in the matter. The Improving Federal Financial Management Act (S. 75) was reintroduced in the 119th Congress in January 2025 and the language remains unchanged as it relates to this matter. As of February 2025, the 119th Congress has taken no further action on this matter. | |

| Congress should consider legislation to require deputy CFOs in CFO Act agencies to have defined responsibilities consistent with the breadth of those of the agency CFOs. (Matter for Consideration 2) | The Improving Federal Financial Management Act (S.4700) was introduced in the 118th Congress and reported to the Senate floor, but no further action was taken. The language in this bill was substantively identical to the bill (HR.7164) introduced in the 117th Congress and substantially similar to the language used in the matter. The Improving Federal Financial Management Act (S. 75) was reintroduced in the 119th Congress in January 2025 and the language remains unchanged as it relates to this matter. As of February 2025, the 119th Congress has taken no further action on this matter. | |

| Congress should consider legislation to require the Director of OMB to prepare and submit to the appropriate committees of Congress a government-wide 4-year financial management plan (with timing to match the GPRA reporting requirements) and an annual financial management status report. a. The plan should include actions for improving financial management systems, strengthening the federal financial management workforce, and better linking performance and cost information for decision-making. b. The plan should be developed in consultation with the CFO Council, the Chief Information Officers Council, the Chief Data Officer Council, the Chief Acquisition Officers Council, CIGIE, GAO, and other appropriate financial management experts. (Matter for Consideration 3) |

The Improving Federal Financial Management Act (S.4700) was introduced in the 118th Congress and reported to the Senate floor, but no further action was taken. The language in this bill was substantively identical to the bill (HR.7164) introduced in the 117th Congress and substantially similar to the language used in the matter. The Improving Federal Financial Management Act (S. 75) was reintroduced in the 119th Congress in January 2025 and the language remains unchanged as it relates to this matter. As of February 2025, the 119th Congress has taken no further action on this matter. | |

| Congress should consider legislation to require each CFO at a CFO Act agency, in consultation with financial management and other appropriate experts, to prepare an agency plan to implement the 4-year government-wide financial management plan prepared by OMB. (Matter for Consideration 4) | The Improving Federal Financial Management Act (S.4700) was introduced in the 118th Congress and reported to the Senate floor, but no further action was taken. The language in this bill was substantively identical to the bill (HR.7164) introduced in the 117th Congress and substantially similar to the language used in the matter. The Improving Federal Financial Management Act (S. 75) was reintroduced in the 119th Congress in January 2025 and the language remains unchanged as it relates to this matter. As of February 2025, the 119th Congress has taken no further action on this matter. | |

| Congress should consider legislation to require the Director of OMB to prepare comprehensive financial management performance-based metrics and use these metrics to evaluate the financial management performance of executive agencies. The metrics should be included in the government-wide and agency-level financial management plans, and agencies' performance against the metrics should be reported in the annual financial management status reports. (Matter for Consideration 5) | The Improving Federal Financial Management Act (S.4700) was introduced in the 118th Congress and reported to the Senate floor, but no further action was taken. The language in this bill was substantively identical to the bill (HR.7164) introduced in the 117th Congress and substantially similar to the language used in the matter. The Improving Federal Financial Management Act (S. 75) was reintroduced in the 119th Congress in January 2025 and the language remains unchanged as it relates to this matter. As of February 2025, the 119th Congress has taken no further action on this matter. | |

| Congress should consider legislation to require the head of each executive agency to identify, and if necessary develop, the key financial management information, in addition to financial statements, needed for effective financial management and decision-making. (Matter for Consideration 6) | The Improving Federal Financial Management Act (S.4700) was introduced in the 118th Congress and reported to the Senate floor, but no further action was taken. The language in this bill was substantively identical to the bill (HR.7164) introduced in the 117th Congress and substantially similar to the language used in the matter. The Improving Federal Financial Management Act (S. 75) was reintroduced in the 119th Congress in January 2025 and the language remains unchanged as it relates to this matter. As of February 2025, the 119th Congress has taken no further action on this matter. | |

| Congress should consider legislation to require the head of each executive agency to annually assess and separately report their conclusion on the effectiveness of internal controls of the agency over financial reporting and other key financial management information. (Matter for Consideration 7) | The Improving Federal Financial Management Act (S.4700) was introduced in the 118th Congress and reported to the Senate floor, but no further action was taken. The language in this bill was substantively identical to the bill (HR.7164) introduced in the 117th Congress and substantially similar to the language used in the matter. The Improving Federal Financial Management Act (S. 75) was reintroduced in the 119th Congress in January 2025 and the language remains unchanged as it relates to this matter. As of February 2025, the 119th Congress has taken no further action on this matter. | |

| Congress should consider legislation to require auditors, as part of each financial statement audit of an executive agency, to test and report on internal control over financial reporting and other key financial management information. (Matter for Consideration 8) | The Improving Federal Financial Management Act (S.4700) was introduced in the 118th Congress and reported to the Senate floor, but no further action was taken. The language in this bill was substantively identical to the bill (HR.7164) introduced in the 117th Congress and substantially similar to the language used in the matter. The Improving Federal Financial Management Act (S. 75) was reintroduced in the 119th Congress in January 2025 and the language remains unchanged as it relates to this matter. As of February 2025, the 119th Congress has taken no further action on this matter. |