National Flood Insurance Program: Congress Should Consider Updating the Mandatory Purchase Requirement

Fast Facts

Flood insurance protects homeowners from financial loss after a flood.

FEMA's National Flood Insurance Program requires homeowners with federally regulated mortgages to purchase flood insurance for properties located in high-risk areas. But some of FEMA's floodplain maps delineating those areas are outdated. For example, land development may have altered flood-prone areas since the maps were created. Most maps also do not reflect how climate change may affect flood risk.

Congress should consider requiring FEMA to evaluate how updated flood risk information could be used to determine which properties must have insurance.

Canal debris in the Florida Keys following Hurricane Irma

Highlights

What GAO Found

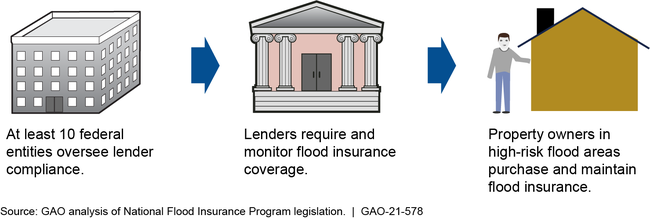

The mandatory purchase requirement mandates flood insurance for certain high-risk properties and was established to increase the number of households with flood insurance. Lenders must verify that certain properties have flood insurance. At least 10 federal entities oversee lenders' compliance, including the federal banking regulators, among others (see figure). The most frequent violation the regulators identified was related to a lack of or insufficient flood insurance coverage for properties subject to the requirement. If regulators identify violations, lenders are required to take corrective actions, and if a pattern or practice of certain flood insurance violations is found, monetary penalties may be assessed against them.

Oversight of the Mandatory Purchase Requirement

The Federal Emergency Management Agency (FEMA), which administers the National Flood Insurance Program (NFIP), engages in a variety of efforts to help increase consumer participation in the flood insurance market (one of the agency's goals). However, FEMA does not effectively use information related to compliance with the requirement to identify ways to meet this goal. Information currently maintained by FEMA and other federal entities could help inform FEMA on noncompliance trends and patterns and help FEMA to develop strategies to address them. By using internal and external information to better understand compliance with the requirement, and facilitating the sharing of this information among the federal entities with responsibilities related to the requirement, FEMA may help reduce instances of noncompliance, increase consumer participation, and limit the federal government's fiscal exposure to future flood losses. FEMA's floodplain maps—which, by law, delineate those properties subject to the requirement—have limitations. For example, they may not reflect current flood hazards or the potential for flooding from some types of events, such as heavy rainfall. FEMA has efforts underway that can assess flood risk more comprehensively. However, FEMA has not evaluated how the new information could be incorporated into the requirement because the agency believes it has a limited role in implementing the requirement. In addition, changes to the maps for the purpose of implementing the requirement could impact other aspects of NFIP. An evaluation by FEMA of how its new flood risk information could be used to designate which properties are subject to the requirement could help Congress revise the requirement to better increase consumer participation and reduce future federal disaster assistance expenditures.

Why GAO Did This Study

Flood insurance plays a key role in helping homeowners reduce the financial effects of floods, reduces the need for federal disaster assistance, and lowers costs for American taxpayers. NFIP makes federally backed flood insurance available to property owners in qualifying communities. The mandatory purchase requirement requires property owners in NFIP communities to purchase flood insurance if, among other things, they have mortgages from federally regulated lenders.

GAO was asked to review the implementation of the mandatory purchase requirement. This report (1) describes federal entities' oversight of the requirement, (2) examines the extent to which FEMA uses information about compliance with the requirement, and (3) examines the use of FEMA floodplain maps to determine who must purchase flood insurance. GAO reviewed documentation from federal entities, analyzed data on lender violations of the requirement, and interviewed officials and other stakeholders.

Recommendations

Congress should consider requiring FEMA to evaluate how its new flood risk information could be used to determine which properties should be subject to the requirement and report to Congress on any recommendations. GAO also is making two recommendations to FEMA, including that FEMA use information related to the requirement to increase consumer participation in the flood insurance market. FEMA agreed with the recommendations.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider requiring FEMA to evaluate how comprehensive and up-to-date flood risk information could be used to determine which properties should be subject to the mandatory purchase requirement and report to Congress with recommendations, if any, on revising the requirement. (Matter for Consideration 1) | As of March 2024, no legislative action has been taken to require FEMA to evaluate how comprehensive and up-to-date flood risk information could be used to determine which properties should be subject to the mandatory purchase requirement and report to Congress with recommendations, if any, on revising the requirement. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Emergency Management Agency |

Priority Rec.

The Deputy Associate Administrator of FEMA's Federal Insurance and Mitigation Administration should determine what information is available—both internally and externally—related to the mandatory purchase requirement, and use it to develop strategies for increasing consumer participation in the flood insurance market. (Recommendation 1) |

DHS agreed with this recommendation. As of December 2023, DHS has implemented this recommendation. DHS outlined its plan to determine available information both internally and externally that could be used to develop strategies for increasing consumer participation in the flood insurance market. As of December 2022, DHS completed its review of internal available data and existing research conducted by agencies and researchers in November 2022 to help develop strategies for increasing consumer participation in the flood insurance market. DHS officials told us it was conducting a policy and legal analysis for communicating with potential policyholders who have received prior individual assistance and are subject to the Mandatory Purchase Requirement. Once the analysis was complete, DHS planned to conduct outreach to individuals and households, as appropriate. In addition, DHS developed a comprehensive marketing strategy based on internal and external research related to flood insurance and is using a variety of mediums to attract new policyholders, retain existing policyholders, and win back former policyholders, such as utilizing radio spots, news publications, billboards, and other messaging techniques. DHS also developed an approach for communicating with policyholders who have previously received assistance from FEMA, using mailings to encourage these policyholders to retain their insurance after their group policy expires. By using internal and external information related to the mandatory purchase requirement, FEMA has begun to better target its outreach to communities, lenders, property owners, and other stakeholders to increase consumer participation in the flood insurance market.

|

| Federal Emergency Management Agency |

Priority Rec.

The Deputy Associate Administrator of FEMA's Federal Insurance and Mitigation Administration should evaluate and report to Congress with recommendations on how comprehensive and up-to-date flood risk information could be used to determine which properties should be subject to the mandatory purchase requirement. (Recommendation 2) |

As of April 2024, DHS has implemented this recommendation. Initially, DHS outlined plans to assess data and make it available to policyholders and others regarding flood risk. In 2022, DHS developed potential legislative proposals that included a suggested changes on ways to simplify and clarify FEMA's mapping authority and provide flexibility for FEMA to produce regulatory maps and non-regulatory flood hazard and flood risk information products to enhance the understanding of flood risk. In 2022, DHS officials told us they completed analysis comparing flood insurance premiums to the latest flood risk information for specific geographies and planned to brief FEMA leadership in November 2022 on their findings and recommendations on which flood risk datasets may inform the mandatory purchase requirement. In December 2023, DHS completed its draft report to Congress on its evaluation of flood risk data and recommended possible uses of flood risk information to inform mandatory purchase requirements. On April 12, 2024, FEMA provided the report to Congress. By completing this analysis along with other proposed NFIP reforms, FEMA has provided information to Congress to help inform its decision making on how, if at all, to revise the mandatory purchase requirement and improve the ability of the requirement to increase consumer participation and reduce future federal disaster assistance expenditures. Each of these goals will continue to be important as flood risk is expected to increase in the future.

|