Federal Debt Management: Treasury Quickly Financed Historic Government Response to the Pandemic and is assessing Risks to Market Functioning

Fast Facts

The federal response to COVID-19 led to unprecedented spending. Treasury quickly sold securities to raise $3.8 trillion. Meanwhile, Treasury increased its cash-on-hand to over $1 trillion to help deal with the uncertainty around federal pandemic-related spending.

Changes in the amount of cash that Treasury keeps on hand can affect investor demand for Treasury securities—so we recommended Treasury clarify its policy and communicate more clearly about any changes.

Pandemic-related uncertainty also led many investors to cash in their Treasury securities—severely disrupting the market. Treasury plans to examine ways to mitigate future disruptions.

Highlights

What GAO Found

In response to COVID-19, in March 2020 many investors rapidly sold their Treasury securities for cash. This led to a severe liquidity disruption when prices fell and transaction costs rose for Treasury notes and bonds in the secondary market. The Federal Reserve acted quickly to support market functioning, including purchasing trillions of dollars of Treasury securities.

This market disruption highlighted risks to the Treasury market. For example, growth in federal debt and regulatory changes may reduce broker-dealers' willingness and ability to intermediate trades (facilitate purchases and sales) of Treasury securities for investors. In April 2021 Treasury initiated an interagency effort to examine options that could help mitigate future disruptions in the market.

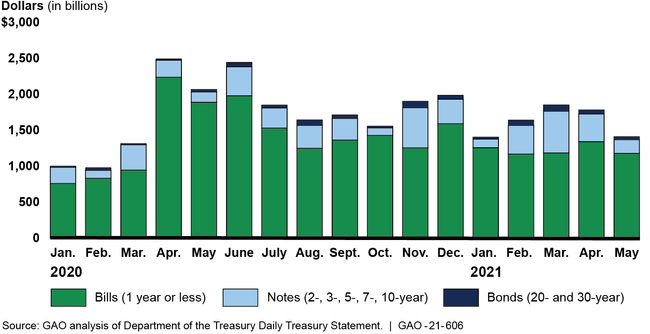

Following the market disruption, Treasury quickly raised trillions of dollars to fund the federal response to COVID-19. It dramatically increased its issuance of bills—including adding regular, weekly auctions of cash management bills, which have historically been issued irregularly to cover near-term financing gaps. The bills were met with strong investor demand. For example, GAO found almost no difference between cash management bill and other bill yields during this time.

Monthly Gross Issuance of U.S. Treasury Bills, Notes, and Bonds

Note: Notes and bonds includes Treasury Floating Rate Notes and Inflation Protected Securities.

Due to the uncertainty created by COVID-19, Treasury maintained a historically high operating cash balance of around $1.6 trillion. Its stated policy is to hold a level of cash generally sufficient to cover one week of outflows. However, other factors not explicitly reflected in its policy informed how it managed the cash balance during COVID-19. Market participants told GAO that they were unclear about all of these factors. They said that understanding the level and trajectory of the cash balance is important because it affects market expectations for the size of Treasury issuance, supply of bank reserves, and short-term lending rates—all of which inform their business strategies and support market functioning. Additionally, uncertainty about the size of the cash balance can lead to volatility in financial markets. This, in turn, can affect Treasury's borrowing costs.

Why GAO Did This Study

The federal government's fiscal response to the COVID-19 pandemic dramatically increased the government's borrowing needs. Treasury borrows money needed by issuing Treasury securities. The ability to borrow large amounts of money quickly and cheaply is especially important during a crisis, when government spending tends to increase and revenues tend to decrease. Any disruptions in investor demand for Treasury securities or the functioning of the Treasury market can have costly implications for the federal government and taxpayers.

The CARES Act includes a provision for GAO to report on its monitoring and oversight efforts related to the COVID-19 pandemic. This report examines (1) how the cost and liquidity of Treasury securities changed during COVID-19; (2) actions Treasury is taking to mitigate future disruptions; and (3) the actions Treasury took to finance the federal government's response to the pandemic.

GAO analyzed data on Treasury securities; reviewed agency and market research; and interviewed market participants across key financial sectors (e.g., broker-dealers, banks, mutual and money market funds), market experts, and Treasury and Federal Reserve officials.

Recommendations

GAO recommends that Treasury clarify the department's policy for managing its operating cash balance to include all relevant factors it considers when determining the appropriate cash balance and communicate this policy to the public. Treasury agreed with the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should clarify the department's policy for managing the operating cash balance to include all relevant factors it considers when determining the appropriate cash balance and communicate the policy to the public. (Recommendation 1) |

In February 2022, Department of Treasury Debt Management officials publicly clarified the department's cash management approach consistent with our recommendation. In its February 2022 Quarterly Refunding policy statement, Debt Management officials re-stated Treasury's cash balance policy to include relevant factors that Treasury considers which may affect how the policy is implemented in practice. For example, officials stated that while Treasury seeks to maintain funds sufficient to cover its one-week ahead cash need, this level is neither a target nor a maximum balance, but rather a minimum level of cash Treasury intends to maintain. Further, Treasury's projected cash needs may be uncertain due to a variety of factors, such as changes in economic conditions which affect tax revenues and the potential for legislative changes that affect short-term cash flows. Officials also stated that Treasury evaluates cash flow projections not only for the week ahead but also for subsequent weeks and months. This process often results in Treasury holding a cash balance above the minimum one-week level. In addition to making clarifications in its policy statement, the Debt Management Office also provided updated analysis of how they implemented their cash management policy in 2020 and 2021. These documents and materials were communicated to market participants and are publicly available on the Treasury website.

|