Banking Services: Regulators Have Taken Actions to Increase Access, but Measurement of Actions' Effectiveness Could Be Improved

Fast Facts

Low-income, less-educated, and minority households are less likely to have bank accounts—which are essential for households' financial well-being. People have cited high fees, minimum balance requirements, and other reasons why they don't have bank accounts.

Federal agencies have worked to increase banking access. For example, the Federal Deposit Insurance Corporation piloted a public awareness campaign on the benefits of bank accounts.

Are these agencies' efforts working? Many of the agencies don't know—so we recommended developing performance measures for these efforts to help determine how effective they are.

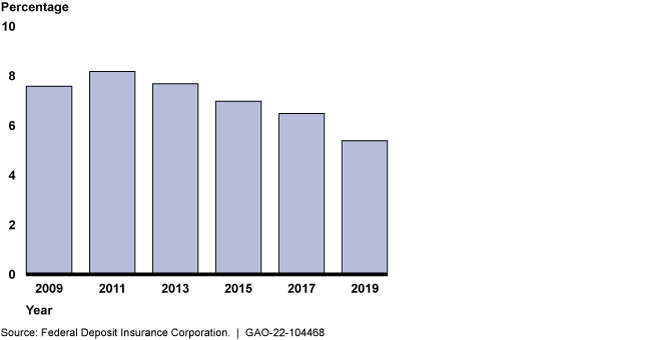

Estimated Percentage of Households Without Bank Accounts in the United States, 2009-2019

Highlights

What GAO Found

Lower-income, less-educated, and minority households are more likely to be unbanked (not have a checking or savings account) or be underbanked (have a checking account but use alternative financial services, which can be costly), according to GAO analysis of Federal Deposit Insurance Corporation (FDIC) survey data (see table). Consumers might not use banks for reasons including lack of money, unexpected or high bank fees, lack of trust, and privacy concerns, according to FDIC's survey and market participants and observers.

Banking Status by Household Income, Education, and Race, 2015–2019 (percentage)

|

|

Unbanked |

Underbanked |

Fully banked |

|

|---|---|---|---|---|

|

Income |

Less than $15,000 |

25 |

22 |

53 |

|

|

$15,000–29,999 |

12 |

23 |

66 |

|

|

$30,000 or more |

2 |

18 |

81 |

|

Education |

No high school degree |

22 |

26 |

51 |

|

|

High school degree or more |

5 |

18 |

77 |

|

Race and ethnicity |

Black |

16 |

31 |

53 |

|

|

Hispanic |

14 |

30 |

56 |

|

|

White |

3 |

14 |

83 |

|

Total |

— |

6 |

19 |

75 |

Source: GAO analysis of Federal Deposit Insurance Corporation (FDIC) data. | GAO-22-104468

Note: For more details, see table 2 in GAO-22-104468. Totals do not always add to 100 percent due to rounding.

Several laws and regulatory factors may intentionally or unintentionally affect the cost and availability of basic banking services. For example, two studies found large banks may have increased checking account fees to offset regulatory limits on their fees for processing debit card transactions. By contrast, regulations requiring consumers to choose to receive overdraft protection may have reduced overdraft fees paid by consumers who did not opt in, according to market observers and three studies by the Consumer Financial Protection Bureau.

Actions of the selected regulators GAO reviewed related to unbanked and underbanked households generally focused on research, education, and oversight. But some regulators lack outcome-oriented measures of their efforts to increase banking access or their measures do not cover all their key initiatives. For example, FDIC piloted a public awareness campaign on the benefits of bank accounts. Yet, its measures indicate only whether a task was completed and do not incorporate information on the outcomes (which could be used to assess the activities). The National Credit Union Administration (NCUA) measures how long it takes to process credit union charters, which helps assess timeliness but does not provide information to assess agency performance in facilitating access to credit union services. The Office of the Comptroller of the Currency (OCC) launched an initiative to increase access to credit, including small-dollar loans. But OCC did not incorporate performance measures for a key initiative to enhance banking access. By using outcome-oriented performance measures for their efforts to increase access to banking services, FDIC, NCUA, and OCC could better identify opportunities for improvement across all key initiatives and set priorities accordingly.

Why GAO Did This Study

Access to reliable and affordable banking services is essential for household financial well-being. In 2019, FDIC estimated that 5.4 percent of surveyed U.S. households were unbanked. GAO used the survey data to estimate another 17.9 percent had a bank account but used alternative financial services, such as check cashing or payday loans that can have high fees or interest rates.

GAO was asked to review factors affecting household access to basic banking services. Among other objectives, this report examines factors associated with households' use of basic banking services, statutory and regulatory factors affecting service availability and cost, and the efforts of selected federal financial regulators to address these issues. GAO analyzed survey data from FDIC on unbanked and underbanked households, reviewed studies on laws and regulatory factors, examined agency documentation, and interviewed market participants and observers and agency officials.

Recommendations

GAO recommends that FDIC, NCUA, and OCC establish outcome-based performance measures reflecting the full scope of their efforts to achieve strategic objectives related to access to banking services. The agencies generally agreed with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Deposit Insurance Corporation | The Chairman of FDIC should develop and implement outcome-oriented performance measures for its strategic objective of ensuring access to safe and affordable bank services that reflect leading practices, including demonstrating results, measuring outcomes, and providing useful information for decision-making. (Recommendation 1) |

In May 2024, FDIC officials said the agency is working on implementation of an outcomes measurement framework that reflects FDIC's updated Economic Inclusion Strategic Plan. The officials noted that FDIC's timeframe to complete responsive actions on this recommendation has shifted to June 2025. We will continue to monitor FDIC's progress towards implementing this recommendation.

|

| National Credit Union Administration | The Chairman of NCUA should develop and implement outcome-oriented performance measures for its strategic objective of facilitating access to credit union services that reflect leading practices, including demonstrating results, measuring outcomes, and providing useful information for decision-making. (Recommendation 2) |

In January 2024, NCUA issued its 2024 Annual Performance Plan with performance measures for its strategic objectives related to facilitating access to credit union services. The measures, such as approving certain underserved area expansions that increase consumer access to affordable financial products, include ones that are outcome-oriented and reflect leading practices. The measures will help NCUA better identify opportunities for improvement across key initiatives and set priorities accordingly.

|

| Office of the Comptroller of the Currency | The Comptroller of the Currency should complete efforts to develop and implement performance measures to cover the agency's key efforts for its strategic objective to promote financial inclusion through fair access to financial services—including Project REACh—that reflect leading practices, including demonstrating results, measuring outcomes, and providing useful information for decision-making. (Recommendation 3) |

In March 2024, OCC provided information on its efforts to track the number of Project REACh participants. We are awaiting additional information on relevant performance measures and will continue to monitor OCC's progress towards implementing this recommendation.

|