Unemployment Insurance: DOL Needs to Address Substantial Pandemic UI Fraud and Reduce Persistent Risks

Fast Facts

Congress created 4 new unemployment insurance programs to support workers during the COVID-19 pandemic. Following this expansion, the amount of fraud in these programs increased. We estimate that, during the pandemic, total fraud in these programs was over $60 billion and perhaps much higher.

The Department of Labor has issued guidance, provided funding to states, and recommended improvements to state unemployment insurance programs to address such fraud. However, we testified that the department has yet to develop an antifraud strategy based on leading practices from our Fraud Risk Framework. We've previously recommended that it do so.

Highlights

What GAO Found

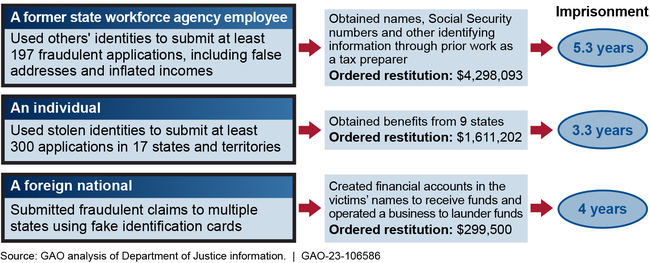

GAO found evidence of substantial levels of fraud and potential fraud in unemployment insurance (UI) during the pandemic. GAO estimated over $60 billion in fraudulent UI payments by extrapolating the lower bound of the Department of Labor's (DOL) 2021 estimated national fraud rate for the regular UI program. However, such an extrapolation has inherent limitations and should be interpreted with caution. GAO is working to develop a more comprehensive estimate on the total extent of UI fraud during the pandemic. The DOL Office of Inspector General's UI fraud investigations resulted in over 1,200 indictments or initial charges from April 2020 through January 2023. Each week that office continues to open over 100 new UI fraud-related investigative matters.

Illustrative examples of unemployment insurance fraud cases

DOL and the states were not adequately prepared to handle UI fraud risks when the pandemic began. DOL has taken some recent steps to address UI fraud risks. For example, it has provided state workforce agencies with fraud-related guidance, integrity tools, and grant funding. DOL, however, has not yet implemented an antifraud strategy as called for by leading practices in GAO's Fraud Risk Framework.

The expediting of COVID-19 relief funding exacerbated an underlying improper-payment problem in the federal government, including UI, which predated the pandemic. For example, DOL reported an increase in estimated improper payments from $8.0 billion (9.2 percent estimated improper payment rate) for fiscal year 2020 to $78.1 billion (18.9 percent estimated improper payment rate) for fiscal year 2021. For fiscal year 2022, DOL reported estimated improper payments of $18.9 billion (22.2 percent estimated improper payment rate).

In June 2022, GAO added the UI system to its High Risk Program based on the system's need for transformation. The system's administrative and program integrity challenges pose significant risks to service delivery and expose the system to significant financial losses. Long-standing challenges with UI administration and outdated IT systems have further affected states' ability to meet the needs of unemployed workers, especially during economic downturns. Such challenges have also contributed to impaired service, declining access, and disparities in benefit distribution.

Why GAO Did This Study

The UI system has faced long-standing challenges with program integrity, which increased dramatically during the pandemic. According to DOL data, expenditures across all UI programs totaled approximately $878 billion from April 2020 through September 2022. This included benefits as part of four new UI programs Congress created to support workers during the pandemic. The unprecedented demand for benefits and the need to quickly implement the new programs increased the risk of financial fraud. Due to these circumstances and other challenges, GAO added the UI system to its High Risk Program in June 2022.

This statement addresses: (1) fraud in the UI programs, (2) UI fraud risks and management of such risks, (3) continued UI improper payment problems, and (4) the addition of the UI system to GAO's High Risk Program.

This statement is based on GAO's body of work related to the UI system during the pandemic. More detailed information on the objectives, scope, and methodology that form the basis of the statement can be found in individual reports, which are listed in the full hearing statement.

Recommendations

As of January 2023, GAO has 19 open recommendations to DOL, including eight to strengthen its management of UI fraud risks. Recommendations include considering options to prevent fraud in programs designed to help self-employed and contingent workers, designating an entity to manage fraud risks, performing fraud-risk assessments, and developing and implementing an antifraud strategy.