Older Americans Act: Agencies Should Take Steps to Better Manage Fraud Risks

Fast Facts

Each year, the Older Americans Act provides billions of dollars in grants for programs that help older people stay in their homes. And as the U.S. population ages, demand will likely increase for services like in-home meals, transportation, and caregiver support.

We looked at fraud risk management in these programs administered by the Departments of Health and Human Services and Labor. Both agencies said the risk is low but they couldn't support their claims because they haven't assessed fraud risks.

Leading practices call for regular assessments of fraud risk. Our 14 recommendations address the need to assess fraud risk in these programs.

Highlights

What GAO Found

The Department of Health and Human Services' (HHS) Administration for Community Living (ACL) and the Department of Labor's Employment and Training Administration (ETA) administer multiple grant programs under the Older Americans Act. Although ACL and ETA identified various staff involved in financial management and program oversight, they have not assigned specific roles, responsibilities, or authorities for leading fraud risk management activities in their Older Americans Act programs. According to leading practices, program managers should designate an entity with defined responsibilities and necessary authority for leading and overseeing fraud risk management activities. Without designating an antifraud entity, ACL and ETA may not be positioned strategically to manage fraud risks in their Older Americans Act programs.

ACL and ETA have not assessed fraud risks in their respective Older Americans Act programs. Officials at ACL and ETA told GAO that their respective Older Americans Act programs are at a low risk for fraud, but they could not substantiate their conclusions, as they have not assessed fraud risks. Prior cases of fraud illustrate that fraud risks exist in Older Americans Act programs. For example, in January 2019, an individual was sentenced to 57 months in prison and ordered to pay restitution of over $600,000 for using Older Americans Act grant funds for personal expenses.

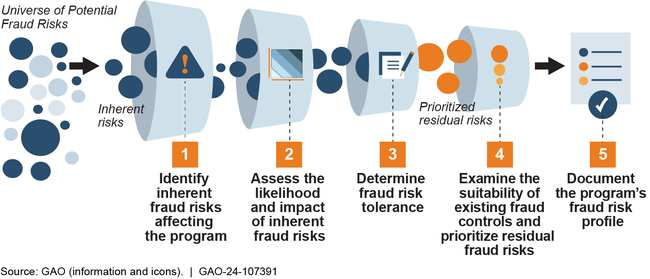

Leading practices in GAO's Fraud Risk Framework call for program managers to plan regular fraud risk assessments that are tailored to their programs. Further, the framework outlines five key elements for assessing fraud risks (see fig.).

Key Elements of the Fraud Risk Assessment Process

Officials at ACL and ETA told GAO that the agencies consider fraud in other risk assessments, such as those for improper payments. However, these assessments do not meet the five key elements above. ACL officials told GAO that the agency plans to assess fraud risks using an HHS tool in 2025. While the tool may help address the five key elements, the quality of ACL's fraud risk assessment will depend on how the agency implements the tool to carry out the assessment. Without policies for regular fraud risk assessments that address the five key elements, ACL and ETA may not effectively prevent, detect, or respond to fraud in their respective Older Americans Act programs.

Why GAO Did This Study

The Older Americans Act of 1965, as amended, authorizes a wide range of grant programs to help older individuals remain in their homes and to provide support for their needs. Older Americans Act programs received over $2.3 billion in funding in fiscal year 2023. As the percentage of the U.S. population in this age group increases, demand for these programs' services—such as in-home meals and caregiver support—will likely increase. GAO has previously found that there is an unmet need for services through the Older Americans Act programs, underscoring the importance of safeguarding these funds.

GAO was asked to evaluate fraud risk management in programs authorized by the Older Americans Act. This report examines the extent to which ACL and ETA have (1) designated entities to lead fraud risk management activities and (2) assessed fraud risks in their respective Older Americans Act programs. GAO reviewed relevant policies and documentation, interviewed agency officials, and compared this information with selected leading practices from GAO's Fraud Risk Framework.

Recommendations

GAO is making 14 recommendations. This includes that ACL and ETA each designate an entity to lead fraud risk management activities in their Older Americans Act programs, establish policies for regularly assessing fraud risks, and address the five key elements of a fraud risk assessment process. Both agencies concurred with the recommendations and described plans to implement them.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Administration for Community Living | The Administrator of ACL should designate an entity to design and oversee fraud risk management activities in its Older Americans Act programs. This should include documenting the roles, responsibilities, and authorities for those leading fraud risk management activities. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Administration for Community Living | The Administrator of ACL should establish a policy for regular fraud risk assessments in its Older Americans Act programs that aligns with the leading practices in the Fraud Risk Framework. (Recommendation 2) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Administration for Community Living | The Administrator of ACL should identify inherent fraud risks in its Older Americans Act programs. (Recommendation 3) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Administration for Community Living | The Administrator of ACL should assess the likelihood and impact of inherent fraud risks in its Older Americans Act programs. (Recommendation 4) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Administration for Community Living | The Administrator of ACL should determine a fraud risk tolerance for its Older Americans Act programs. (Recommendation 5) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Administration for Community Living | The Administrator of ACL should examine the suitability of existing fraud controls and prioritize residual fraud risks in its Older Americans Act programs. (Recommendation 6) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Administration for Community Living | The Administrator of ACL should document a fraud risk profile for its Older Americans Act programs. (Recommendation 7) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Employment and Training Administration | The Assistant Secretary of ETA should designate an entity to design and oversee fraud risk management activities in SCSEP. This should include documenting the roles, responsibilities, and authorities for those leading fraud risk management activities. (Recommendation 8) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Employment and Training Administration | The Assistant Secretary of ETA should establish a policy for regular fraud risk assessments in SCSEP that aligns with the leading practices in the Fraud Risk Framework. (Recommendation 9) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Employment and Training Administration | The Assistant Secretary of ETA should identify inherent fraud risks in SCSEP. (Recommendation 10) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Employment and Training Administration | The Assistant Secretary of ETA should assess the likelihood and impact of inherent fraud risks in SCSEP. (Recommendation 11) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Employment and Training Administration | The Assistant Secretary of ETA should determine a fraud risk tolerance for SCSEP. (Recommendation 12) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Employment and Training Administration | The Assistant Secretary of ETA should examine the suitability of existing fraud controls and prioritize residual fraud risks in SCSEP. (Recommendation 13) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Employment and Training Administration | The Assistant Secretary of ETA should document a fraud risk profile for SCSEP. (Recommendation 14) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|