Payment Integrity: Significant Improvements Are Needed to Address Improper Payments and Fraud

Fast Facts

To safeguard federal funds, it's critical to reduce fraud and improper payments—payments that should not have been made or were made in an incorrect amount. We estimated that the federal government could lose between $233 billion and $521 billion annually to fraud alone.

We testified that agencies have made progress in implementing our recommendations to address fraud and improper payments but need to do more. We have also identified actions Congress can take to hold agencies accountable. For example, scorecards can help Congress track agency performance in preventing, detecting, and recovering improper payments within government programs.

Highlights

What GAO Found

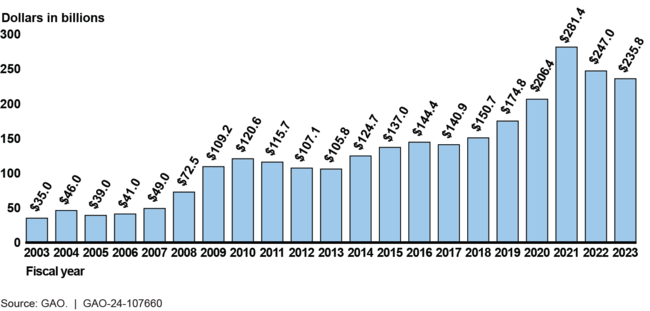

Improper payments and fraud are long-standing and significant problems in the federal government. Since fiscal year 2003, cumulative improper payment estimates by executive branch agencies have totaled about $2.7 trillion. In fiscal year 2023 alone, federal agencies estimated $236 billion in improper payments, representing 71 programs, a small subset of all federal programs. While the fiscal year 2023 estimate is a decrease of about $11 billion from the prior year, this was largely due to Medicaid reducing eligibility requirements for beneficiaries and providers during the COVID-19 public health emergency.

Total Reported Executive Agency Improper Payment Estimates, Fiscal Years 2003–2023

Six program areas were responsible for approximately $200 billion of the $236 billion fiscal year 2023 improper payments estimate:

- Department of Health and Human Services' (HHS) Medicare;

- HHS's Medicaid;

- Department of Labor's Unemployment Insurance;

- Small Business Administration's Paycheck Protection Program;

- Department of the Treasury's Earned Income Tax Credit; and

- Social Security Administration's Supplemental Security Income.

Each of the six selected program areas are currently or have been on GAO's High Risk List of areas with vulnerabilities to fraud, waste, abuse, and mismanagement or in need of transformation. Agencies have made progress in implementing GAO's recommendations for the six program areas, but the agencies can do more to improve payment integrity and address the remaining 14 unimplemented recommendations.

In addition to GAO's work, in fiscal year 2022, the inspectors general (IG) from 10 of the 24 Chief Financial Officers Act agencies found that their agencies did not fully comply with improper payments criteria as established by federal law and related Office of Management and Budget (OMB) guidance. The IGs of the 10 agencies that were not in compliance made at least 30 recommendations to their agencies from these compliance reports that remained open as of May 2024.

Improper payments and fraud are distinct concepts that are not interchangeable but are related. While all fraudulent payments are considered improper, not all improper payments are due to fraud. Unlike improper payment estimates that are produced by a subset of agencies at the program level, in April 2024, GAO estimated total direct annual financial losses across the government from fraud to be between $233 billion and $521 billion, based on data from fiscal year 2018 through fiscal year 2022.

GAO has also identified actions Congress can take to enhance its oversight and hold agencies accountable for reducing improper payments and fraud. Specifically, in March 2022 GAO recommended that Congress consider taking the following actions to enhance the transparency and accountability of federal spending.

- New improper payment reporting. (1) Designate all new federal programs distributing more than $100 million in any one fiscal year as “susceptible to improper payments” and thus, subject to more timely improper payment reporting requirements and (2) require agencies to report improper payment information in their annual financial reports.

- Fraud risk management reporting. Reinstate the requirement that agencies report on their antifraud controls and fraud risk management efforts in their annual financial reports. Such reporting will increase congressional oversight to better ensure fraud prevention during normal operations and emergencies.

- Fraud analytics. Establish a permanent analytics center of excellence to aid the oversight community in identifying improper payments and fraud.

- Internal control plans. Require OMB to provide guidance for agencies to develop internal control plans that can then be put to immediate use for future emergency funding.

- Data sharing. Amend the Social Security Act to make permanent the requirement for the Social Security Administration to share its full death data with Treasury's Do Not Pay working system.

- Chief Financial Officer (CFO) authorities. Clarify that agency CFOs have oversight responsibility for internal controls over financial reporting and key financial information and require agency CFOs to (1) certify the reliability and validity of the improper payment risk assessments and estimates and monitor associated corrective action plans and (2) approve improper payment estimate methodology in certain circumstances.

- USAspending.gov. (1) Clarify the responsibilities and authorities of OMB and Treasury for ensuring the quality of federal spending data available on USAspending.gov and (2) extend the previous requirement for agency IGs to review agency data submissions on a periodic basis.

In addition, Congress can use a variety of tools to provide greater sustained oversight through hearings and the appropriations, authorizations, and oversight processes to incentivize executive branch agencies to improve program integrity and take efforts to prevent fraud. For example, scorecards are one way Congress can track agency performance in preventing, detecting, and recovering improper payments and reducing fraud within government programs.

Why GAO Did This Study

Reducing improper payments—payments that should not have been made or that were made in an incorrect amount—and fraud—obtaining something of value through willful misrepresentation—is critical to safeguarding federal funds and could help achieve cost savings and improve the government's fiscal position. These payment integrity issues also erode public trust in government and hinder agencies' efforts to execute their missions and program objectives effectively and efficiently.

This testimony covers (1) estimates of government-wide improper payments and fraud; (2) the status of improper payments in six high-priority programs, as well as relevant GAO recommendations that have not been fully implemented related to improper payments and fraud within these programs; and (3) actions Congress could take to improve oversight of efforts to reduce improper payments and fraud.

This testimony is primarily based on GAO's recent work on improper payments and fraud. GAO reviewed additional information to determine the improper payment amounts, rates, and root causes for six program areas that represent about 85 percent of all reported improper payment estimates in fiscal year 2023. In addition, GAO analyzed agency financial reports and reviewed the fiscal year 2023 Payment Integrity Information Act of 2019 compliance reports that each agency's IG issued. More detailed information on the scope and methodology of GAO's prior work can be found within each specific report.

For more information, contact M. Hannah Padilla at (202) 512-5683 or padillah@gao.govor Seto Bagdoyan at (202) 512-6722 or bagdoyans@gao.gov.