Investment Management: Federal Entities' Efforts to Increase Opportunities for Minority- and Women-Owned Asset Managers

Fast Facts

Asset management firms manage trillions of dollars, but minority and women-owned firms manage a tiny portion. Our prior report discussed the difficulties these firms face when competing against larger firms for asset management opportunities.

In this report, we found that these firms face several challenges. For example, they may lack the resources to keep client fees low—a challenge larger firms can more easily overcome due to their greater capacity. We found that the use of minority and women-owned firms varied among the federal entities we reviewed, but their overall use of these firms increased compared to our prior report.

Highlights

What GAO Found

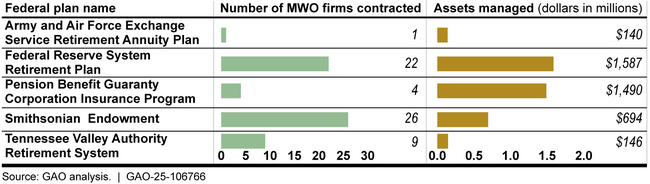

Use of minority- and women-owned asset managers (MWO firms) varied among nine selected federal investment plans reviewed by GAO. In 2022, 61 MWO firms managed about 3 percent of total externally managed assets across five of the nine plans (see figure). The use of MWO firms increased since GAO's prior report on the topic (GAO-17-726). Four of the nine plans did not use MWO firms.

Use of Minority- and Women-Owned (MWO) Asset Management Firms by Selected Federal Plan, 2022

Federal entity officials that manage the selected federal plans and many industry stakeholders GAO spoke with said that MWO firms continue to face challenges in competing for opportunities in the asset management industry that are similar to those that GAO reported in 2017. For example, they said that MWO firms lack the size or resources to keep client fees low, a challenge larger firms can more easily overcome due to their greater capacity and resources.

All seven federal entities that GAO reviewed incorporated key practices that institutional investors can use to increase opportunities for MWO firms. For example, the entities generally conducted outreach to MWO firms and communicated expectations of inclusive practices to their staff and consultants. This represents an improvement from GAO's 2017 review, which found that four of the seven federal entities had not done so. Two executive orders issued in January 2025 directed federal agencies to end diversity-related initiatives. In February 2025, officials from two federal entities said they had not determined whether the orders impacted their application of the key practices; officials from three said there would be no impact because their asset manager selection processes are merit-based; officials from one said they will remove references to MWO firms from its policies; and officials from another declined to comment.

The Securities and Exchange Commission (SEC) and its staff took steps to promote diversity in the asset management industry. For example, in January 2018, SEC introduced a voluntary self-assessment for regulated entities to evaluate their diversity policies and practices and report demographic information. In February 2025, SEC staff said that they were analyzing the potential impact of the executive orders on the industry self-assessment. SEC staff removed staff guidance from the SEC website that addressed investment advisers' consideration of diversity-related factors when recommending or selecting other investment advisers. Accordingly, GAO removed an assessment of this staff guidance and a related recommendation from its review.

Why GAO Did This Study

MWO firms managed about 1.4 percent of the $82 trillion overseen by a sample of asset management firms in 2021, according to an industry report. Some policymakers raised questions about the extent of federal entities' use of MWO firms and the challenges these firms face in competing for opportunities.

GAO was asked to update its 2017 review of federal entities' use of MWO firms. This report describes selected federal entities' use of MWO firms, challenges these firms may face in competing for business, federal entities' alignment with key practices for selecting asset managers, and the status of SEC efforts regarding diversity in the asset management industry, among other objectives.

GAO reviewed investment policies and financial statements of seven federal entities that manage or sponsor nine investment plans (seven retirement plans, one endowment, and one insurance program) that were also reviewed in GAO's 2017 report. GAO reviewed SEC staff reports and press releases. GAO also interviewed or held discussion groups with representatives of SEC, the federal entities, and industry stakeholders including five consulting firms, four industry associations, two researchers, 11 MWO asset management firms, five non-MWO firms, and five nonfederal plans.

For more information, contact Michael E. Clements at ClementsM@gao.gov or Tranchau (Kris) T. Nguyen at NguyenTT@gao.gov.